The difference between CPA vs CA is that CPA is a globally known designation whereas CA is a designation offered in India. The work of both the CPA and the CA consists in examining and making final financial reports, conducting audits, and preparing tax returns for clients.

The difference between CPA vs CA is that CPA or Certified Public Accountant is a designation that is globally recognized while CA or Chartered Accountant is a designation awarded in India. Both the CPA and the CA are qualified individuals who examine financial reports, look into final records, create audit reports and prepare tax returns for a firm or organisation.

Both CPA and CA have equal value when it comes to measuring their responsibilities. Both professions command equal respect and prestige. This article will focus on the difference between CPA vs CA in terms of the syllabus, eligibility criteria, and which should be a better option for a career.

CPA vs CA: Differences

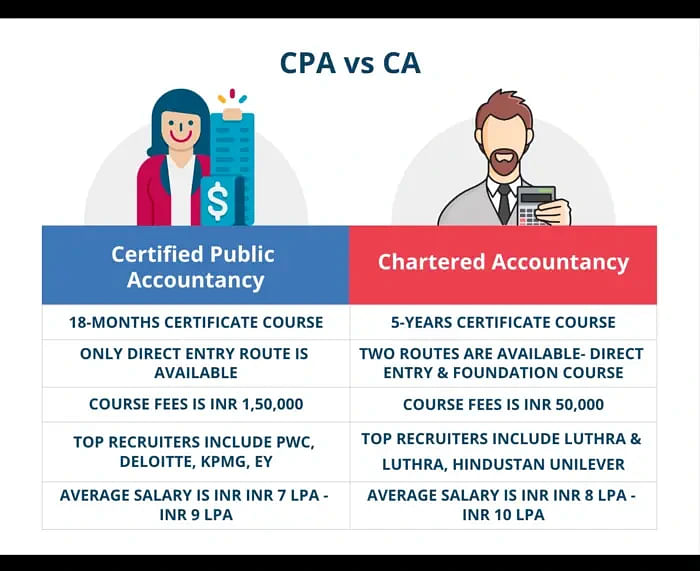

While both the designations - CPA and CA - share almost the same responsibilities, there are certain basic differences between the two. The table below highlights the differences between CPA and CA.

| Particulars | CPA | CA |

| Course Name | Certified Public Accountancy | Chartered Accountancy |

| Duration | 18 months | 4.5 - 5 years |

| Course Level | Certificate | Certificate |

| Eligibility Criteria | The candidate must have completed graduation from a recognised university. |

|

| Course Fee | INR 1.5 Lakh | INR 50000 |

| Top Colleges/ Online Institutes | Unacademy, Edu Pristine, Vedantu, Quint Edge | Shri Ram College of Commerce New Delhi, Sri Venkateswara College New Delhi, Nizam College Hyderabad |

| Average salary | INR 7 LPA - INR 9 LPA | INR 8 LPA - INR 10 LPA |

| Job Profiles | Management Trainee, Bookkeeper, Payroll Clerk, Accounting Assistant | Accounts Clerk, Auditor, Chief Financial Officer, Tax Accountant, Financial Controller, Chartered Accountant |

| Entrance Exams | N/A | Chartered Accountants Common Proficiency Test (CA CPT) |

| Top Recruiters | PWC, Deloitte, KPMG, EY | PWC, Deloitte, Luthra & Luthra, Hindustan Unilever Limited |

Also Check: How to Become a CA in India?

CPA vs CA: Course Details

While CPA and CA have similar jobs and responsibilities, there are few basic differences pertaining to the eligibility criteria, course duration, admission process, and exam structure. All the details regarding these have been shared below.

Eligibility Criteria

The eligibility criteria for CPA and CA can be found below.

CPA

In order to get admission to the CPA course the following criteria must be fulfilled:

- The candidate must have completed the Bachelor’s degree or an equivalent degree

CA

There are two routes of entry to the CA course: the Foundation Course Entry Route and the Direct Entry Route.

For the CA Foundation Course Entry Route, the candidate must fulfil the following criteria:

- The candidate must pass the 12th board examination.

- The candidate must spend at least 4 months after the CA registration.

For the Direct Entry Route, the following are the steps to be followed:

- The candidate must have completed graduation or post-graduation in commerce with at least 55% marks in aggregate.

- Candidates who have completed graduation or post-graduation in other streams must have attained at least 60% marks in aggregate.

Also Check: How to Clear CA Foundation 2025 in First Attempt?

Course Duration

The course duration of CPA is 18 months, whereas that of CA is 4.5 years to 5 years.

Admission Process

The admission processes vary for CPA and CA.

CPA

- The registration for CPA can be done at any time of the year.

- The candidates must pay the exam administration fee before scheduling a Prometric appointment.

- For admission, the candidate must log in to NASBA CPA Candidate Account Portal and then select International Management. International administrative processes applicable to Indian candidates can be found there.

CA

- The candidate must apply for the CPT exam.

- The candidate must qualify in this exam to get admission to the course.

Also Check: 10 Best Career Options in Commerce 2025

Syllabus for CPA vs CA

The syllabus for both CPA and CA are fundamentally different despite great similarities in the job role.

CPA

The syllabus for CPA consists of:

- Paper 1: Financial Accounting and Reporting (FAR)

- Paper 2: Auditing & Attestation (AUD)

- Paper 3: Regulation (REG)

- Paper 4: Business Environment & Concepts (BEC)

CA

The syllabus for CA is divided into three categories.

1. The syllabus for CA Foundation is:

- Paper 1: Principles and Practice of Accounting

- Paper 2: Business Laws & Business Correspondence and Reporting

- Paper 3: Business Mathematics and Logical Reasoning & Statistics

- Paper 4: Business Economics & Business and Commercial Knowledge

2. The Syllabus for CA Intermediate is:

CA Intermediate Group 1:

- Accounting

- Cost and Management Accounting

- Taxation (Income Tax Law and Indirect Taxes)

- Corporate and other Laws (Company and Other Laws)

CA Intermediate Group 2:

- Advanced Accounting

- Auditing and Assurance

- Enterprise Information Systems

- Enterprise Information Systems & Strategic Management

- Strategic Management

- Financial Management

- Economics or Finance

- Financial Management and Economics for Finance

3. The Syllabus for CA Final Course is:

CA Final Group 1 Syllabus:

- Financial Reporting

- Strategic Financial Management

- Corporate and Economics Laws

- Advanced Auditing and Professional Ethics

CA Final Group 2 Syllabus:

- Strategic Cost Management and Performance Evaluation

- Direct Tax Laws & International Taxation

- Indirect Tax Laws

- Elective Paper

Also Check: CA (Chartered Accountancy) Syllabus and Subjects

Top Colleges for CPA and CA

The candidates who wish to enrol in any of the courses between CPA and CA, must be aware of the top colleges and institutes available in India. The top colleges and institutes for CPA and CA have been mentioned in the table below:

| Top Institutes for CPA | Top Institutes for CA |

| Unacademy | Nizam College Hyderabad |

| Edu Pristine | Sri Venkateswara College New Delhi |

| Quint Edge | Shri Ram College of Commerce New Delhi |

| Vedantu | Vidyasagar Career Institute Limited |

Also Check: Top CA Institutes in India

Job Scope of CPA vs CA

The career scope of CPA and CA are almost similar. While CPA is an internationally acclaimed certification, candidates working as CA are certified in India. The job scope for both the certifications have been mentioned below.

| CPA Job Scope and Salary | |

| Job Role | Average Salary (Per Annum) |

| Financial Advisor | INR 5 Lakh |

| Management Reporter | INR 15 Lakh |

| Corporate Finance Controller | INR 24.5 Lakh |

| Internal Auditor | INR 7.8 Lakh |

| CA Job Scope and Salary | |

| Job Role | Average Salary (Per Annum) |

| Chartered Accountant | INR 9.6 Lakh |

| Chief Financial Officer | INR 47.2 Lakh |

| Tax Accountant | INR 4.7 Lakh |

| Financial Controller | INR 22.5 Lakh |

Also Check: CMA Vs CA: Which one to choose?

Top Recruiters of CPA vs CA

Few of the leading companies and multinational organisations are the recruiters for both the professions. The top recruiters for both CPA and CA have been mentioned below:

| Top Recruiters | |

| CPA | CA |

| KPMG | Hindustan Unilever Limited |

| EY | PWC |

| PWC | Luthra & Luthra |

| Accenture | Deloitte |

Also Check: Top CA Firms in India 2025

CPA VS CA: Which is Better?

There might be confusion around which career option to go for between CPA vs CA. The following few points must be considered while making a career decision.

- If a candidate wishes to work abroad, it is advisable that he/she chooses the CPA over CA, the reason being that CPA is a globally accepted certification.

- If a candidate wishes to work within India, he/she can go with Chartered Accountancy since it is the most accepted profession in India between the two.

- If a candidate wants to start his/her career right away, it is best to choose CPA since the certificate course has a duration of only eighteen months.

- For those who want to take the longer route, can opt for CA which has a course duration of 4.5 to 5 years.

Also Check: 10 Best Career Options in Commerce 2025 [With and Without Maths]