In ICWA vs CA, ICWA professionals specialize in analyzing and managing costs within organizations to enhance profitability and operational efficiency. And CA professionals are involved in maintaining financial records, ensuring compliance with laws, and providing strategic financial advice.

Table of Contents

To understand ICWA vs CA, the basic concept plays an important role. ICWA which mainly focuses on cost management, internal control, and cost auditing wheras CA, on the other hand, emphasises financial accounting, tax planning, and auditing.

Also, as per the basic CA eligibility, aspirants are required to complete Class 12 or a bachelor's degree for direct entry. And for as per ICWA or CMA eligibility the course is open to students after Class 12 or graduation.

ICWA vs CA: Overview

ICWA and CA are both professional accounting courses that are offered in India. However, the overview of ICWA vs CA designations, and they are tabulated below.

| Parameters | ICWA | CA |

| Full Form | Institute of Cost and Works Accountants | Chartered Accountancy |

| Levels Of Examination | Foundation | CA Foundation Examination |

| Intermediate Examination | CA Intermediate | |

| Final Examination | CA Final Examination | |

| Eligibility Criteria | Candidates have qualified Class 10th or equivalent from an accredited board. | The candidate must have passed Class 12. |

| Must have qualified Senior Secondary Examination as per the 10+2 pattern. | Completed four months of study period after CA registration to be able to appear for the Foundation examination. | |

| Membership Requirement | Nothing prescribed | Candidates must complete the required work experience requirements in addition to the final course examination. |

| Salary Range | Approx INR 1, 00,000 to INR 6, 00,000 annually | Approx INR 2, 00,000 to INR 12, 00,000 annually. |

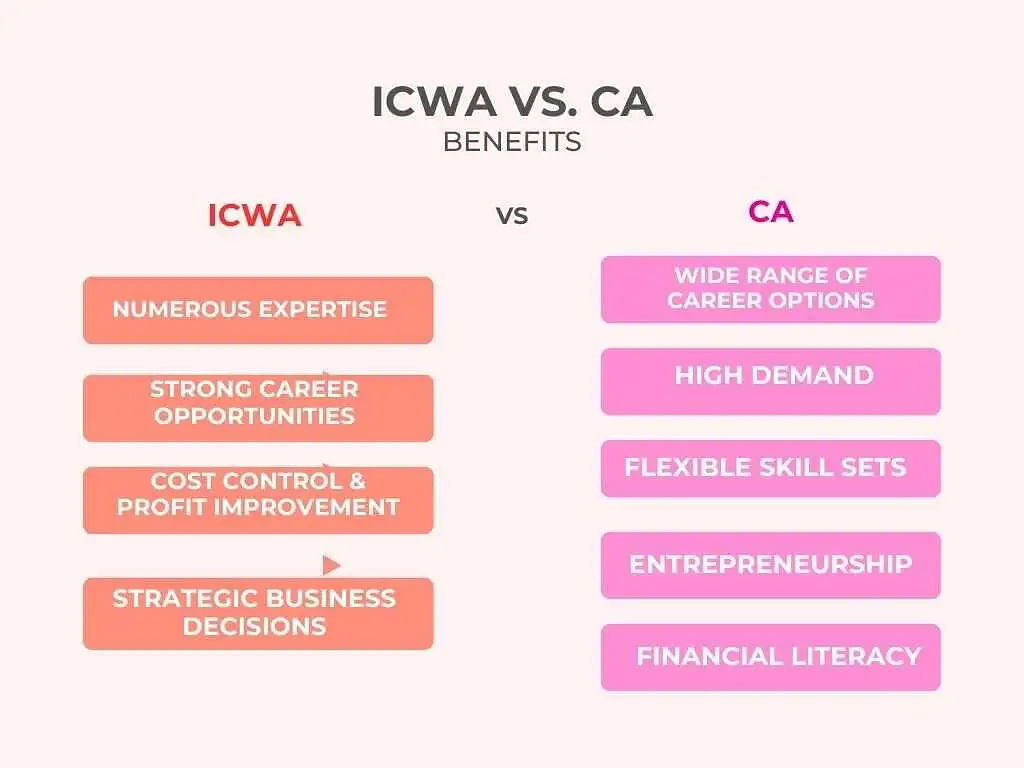

ICWA vs CA: Benefits

ICWA vs CA are two distinct professional qualifications that offer numerous benefits and the choice between ICWA and CA depends on the student's career goals, interests, and the specific area of finance and accounting, the benefits of doing ICWA and CA are mentioned below.

Benefits of Doing ICWA

The ICWA course is particularly helpful since it gives candidates the opportunity to pursue a career in cost and management accounting. In addition to working as cost accountants, ICWA holders can fill managerial positions in a variety of businesses in both the public and private sectors.

- Numerous expertise: Expertise in Budgeting, Cost Control, and Management Accounting: ICWA provides professionals with specific knowledge and skills in these fields. This knowledge is useful in many different areas and spheres.

- Strong Career Opportunities: ICWAs are in high demand across a wide range of industries, including production, manufacturing, logistics, finance, and services. The degree makes a variety of job prospects in the public and commercial sectors possible.

- Cost control and profit improvement: ICWAs are essential in assisting businesses with cost analysis, resource optimization, and profitability enhancement. They support efficient cost-management and budgeting techniques.

- Support for Strategic Business Decisions: ICWAs provide essential financial information and analysis. They support businesses with price setting, project evaluation, and expansion planning.

Benefits Of Doing CA

Numerous advantages make earning a Chartered Accountancy (CA) qualification a desirable career path for those with an interest in finance, accounting, and auditing. The following are some major advantages of becoming a chartered accountant.

- Wide Range of Career Options: CAs can pursue a variety of careers in a number of different fields, such as public practice, corporate finance, banking, government, and the nonprofit sector.

- High Demand: Due to their proficiency in financial management, taxation, and auditing, CAs are in constant demand. Demand frequently results in competitive pay and employment security.

- Flexible skill: A flexible skill set that encompasses financial analysis, auditing, tax planning, budgeting, and strategic financial management is provided by CA training to students.

- Entrepreneurship: To gain independence and establish their brands, many CAs decide to launch their own accounting firms or consulting enterprises.

- Financial literacy: CAs are well-equipped to manage their accounts and investments since they have a thorough awareness of economic issues.

ICWA vs CA: Top Colleges

ICWA vs CA are professional qualifications offered by their respective institutes, below are the top institutes for ICWA and CA programs in India.

Best Colleges for ICWA Course

Some well-known institutions and colleges that offer the ICWA/CMA course are listed below for candidates interested in the course.

- Institute of Professional Studies and Research (IPSAR), Cuttack

- Narsee Monjee College of Commerce and Economics, Mumbai

- Singar Academy, Tiruchirappalli

- Bharathi Educational Centre, Namakkal

- Course Crest Academy, Bangalore

- The Institute of Cost Accountants of India (ICAI) Thiruvananthapuram

- GC Rao Academy, Bangalore

Best Colleges for CA Course

Some well-known institutions and colleges that offer the CA course are listed below for candidates interested in the course.

- Shri Ram College of Commerce

- Loyola College

- Christ University

- Hindu College, Delhi

- SVKM's Narsee Monjee College of Commerce and Economics

- St. Joseph’s College of Commerce

- St. Xavier's College Kolkata

ICWA vs CA: Eligibility Criteria

The eligibility criteria for both the professional courses ICWA and CA are listed below for the candidate's reference.

ICWA Eligibility and Course Details:

- Open to students after Class 12 or graduation.

- The course has three levels: Foundation, Intermediate, and Final.

- It includes practical training and focuses on subjects like cost accounting, management accounting, and business laws.

Also Check: How to Become a CMA?

CA Eligibility and Course Details:

- Requires completion of Class 12 or a bachelor's degree for direct entry.

- The course consists of three levels: CA Foundation, CA Intermediate, and CA Final.

- Articleship training of 2.5 to 3 years is mandatory, providing hands-on experience in auditing and taxation.

Also Check: How to Become a CA in India?

ICWA vs CA: Scopes and Job Opportunity

ICWA: Scopes and Job Opportunity

There are multiple scopes and job opportunities if the candidate is interested in ICWA, a few of them are listed below:

- Cost and Management Accounting: ICWA professionals are experts in cost accounting, financial management, and management accounting and can work as cost and Management Accountants.

- Financial Analysis: ICWAs are professionals who work as financial analysts, critically analyse financial data, conduct financial research, and support investment decisions of firms and companies.

- Management Consulting: ICWAs can opt for careers like management consultants, advising businesses and firms on improving their operational efficiency, cost cutting, and financial performance of the firms and company.

- Audit and Assurance: ICWAs can pursue careers in audit and assurance services they can work as internal auditors or cost auditors to ensure financial transparency and compliance to measure the company's performance.

CA: Scopes and Job Opportunity

- Tax Consultant and Advisor: CA professionals are specialists in planning taxations, and managing assets of businesses to minimize tax liabilities.

- Financial Analyst: They analyze financial data, prepare reports, and balance sheets to support investment decisions and also show the correct direction to the financial planning of the firm.

- Professor and Teacher: CAs who are interested in academics can become educators, teaching various subjects like accounts, statistics, and finance courses at universities and institutes online or offline.

- Investment Banking: Investment banking is one of the most lucrative options as it is high-value job that pays extremely well to the professionals.

ICWA vs CA: Jobs and Salary

ICWA vs CA are both prestigious professional qualifications in the field of finance and accounting, and the most lucrative job profiles and average salary ranges are tabulated below:

ICWA: Job Profile and Salary

Aspirants can check the overview of ICWA jobs, scope and salary in the table given below

| Job Profiles | Average Salary (in INR) |

| Cost Accountant | 8 LPA |

| Financial Analyst | 10 LPA |

| Management Accountant | 11 LPA |

| Cost Controller | 5 LPA |

| Finance Manager | 8 LPA |

| Tax Consultant | 9 LPA |

CA: Job Profile and Salary

Aspirants can check the overview of CA job, scope and salary in the table given below

| Job Profiles | Average Salary (in INR) |

| Chartered Accountant | 12 LPA |

| Financial Controller | 16 LPA |

| Tax Accountant | 10 LPA |

| Chief Financial Officer | 6 LPA |

| Auditor | 7 LPA |

| Accounts Clerk | 6 LPA |

Conclusion

Depending upon the professional goals, interests, and precise skills and knowledge, candidates should choose between the ICWA vs CA professions. When selecting which is preferable, one should keep the following important aspects in mind.

- Interests and Career Goals: Take into account your interests and the work an individual hopes to do in the future. CA may be a better fit if the interests lie more in financial management and audit. ICAI might be a better fit if cost management and budgeting are your interests.

- Desired industry: Consider your desired industry and sector while choosing an industry. Different industries require various skill sets. Cost accountants, for instance, are highly valued in the manufacturing and production sectors.

- Flexibility: CA allows candidates to work in a variety of professions and sectors and offers greater freedom. In terms of cost control, ICAI has more expertise.

- Global Mobility: CA may provide better international recognition if one intends to work abroad or for a multinational organization.

- Long-Term Goals: Consider your long-term career goals while setting objectives. Although they may lead individuals in various paths, both degrees ICWA vs CA can result in prosperous jobs.

POST YOUR COMMENT