Home to world-class universities, Canada is a great option for students interested in pursuing masters degree programs in the accounting field. Read on to explore complete details about masters in accounting in Canada, including best universities, fee structure, eligibility criteria, and more.

Table of Contents

- Best Colleges in Canada for Masters in Accounting

- Course Curriculum for Masters in Accounting in Canada

- Difference between MBA Accounting and Masters in Accounting

- Master Degree in Accounting in Canada Admission Process

- Why Study Masters in Accounting in Canada?

- Cost of Pursuing Masters in Accounting in Canada

- Career Prospects Post Masters in Accounting in Canada

Masters in Accounting in Canada (MAcc) is a 2-year post-graduate program best suited for students who are looking for career options like IT Auditor, Public or Corporate Accountant, Auditor Fraud Examinee, etc. The annual average cost of pursuing masters in accounting for international students in Canada is approximately 42,300 USD.

Accounting masters in Canada majorly cover areas like taxation, insurance, comptrolling and financial strategies, banking, etc. The average salary for accounting postgraduates in Canada is around 46,300 USD per annum. Moreover, overseas students can obtain scholarships worth 2,300 USD to 3,800 USD to pursue this program.

Best Colleges in Canada for Masters in Accounting

Canada has top-ranked universities and colleges that offer several accounting and finance courses at the post-graduate level. The table below lists some of the top universities in Canada offering masters in accounting, along with their programs, tuition fee, and duration:

|

University |

Program |

Cost (in EUR) |

Duration |

|

Master of Accounting |

5885 |

2 years |

|

|

Master of Management and Professional Accounting |

50,989 |

2 years |

|

|

Accounting MAcc |

22,423 |

1 year 4 months |

|

|

Master of Finance |

5,948 |

1 year |

|

|

Master of Financial Accountability |

9,617 |

2 years |

|

|

MBA (CPA Stream) |

31,801 |

3 years |

|

|

Master of Professional Accounting |

18,009 |

1 year 1 month |

|

|

Accounting MPAcc |

41,610 |

2 years |

Course Curriculum for Masters in Accounting in Canada

To get an overview of the course syllabus for masters in accounting in Canada, one must understand the term-wise areas of study offered. The course curriculum involves core areas of accounting, including the following:

|

Term 1 |

Term 2 |

|

Strategic Performance Management |

Integration and Team Management |

|

Advanced Topics in Taxation |

Integration and Analysis |

|

Advanced Topics in Assurance |

Information Technology and Systems |

|

Advanced Topics in Corporate Finance |

Corporate Governance |

|

Advanced Financial Statement Analysis |

Accounting for Governmental and Not-for-Profit Organizations |

Difference between MBA Accounting and Masters in Accounting

As the two courses sound similar, students often tend to confuse between MBA accounting and masters in accounting. However, there are major differences between the two in terms of their course structure, study areas, scope, job profiles, etc. The differences between the two options are illustrated in the table below:

|

Factors |

MBA Accounting |

Masters in Accounting |

|

Basic Difference |

Major focus on business aspects with a specialization in Accounting. |

Emphasizes mainly upon accounting, including its theory and practical applications. |

|

Core Study Areas |

Economic Performance Analysis, Strategic Cost Management, Audit Theory, etc. |

Accounting, Taxation, Management, etc. |

|

Duration |

1 year (general study) and 1 year (specialization) |

2 years |

|

Job Roles |

Chief Financial Officer, Tax Accountant, Consultant, Business Analyst, etc. |

Management Accountant, Internal or External Auditor, Government Accountant, etc. |

|

Average Salary for Freshers |

59,400 USD |

46,300 USD |

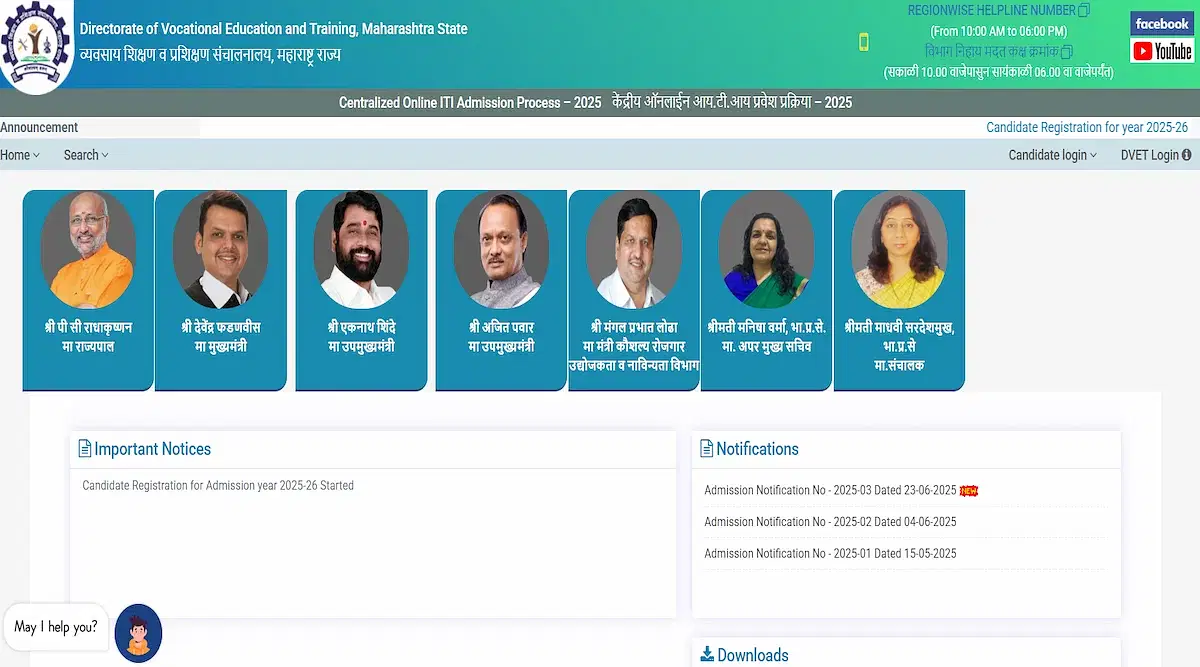

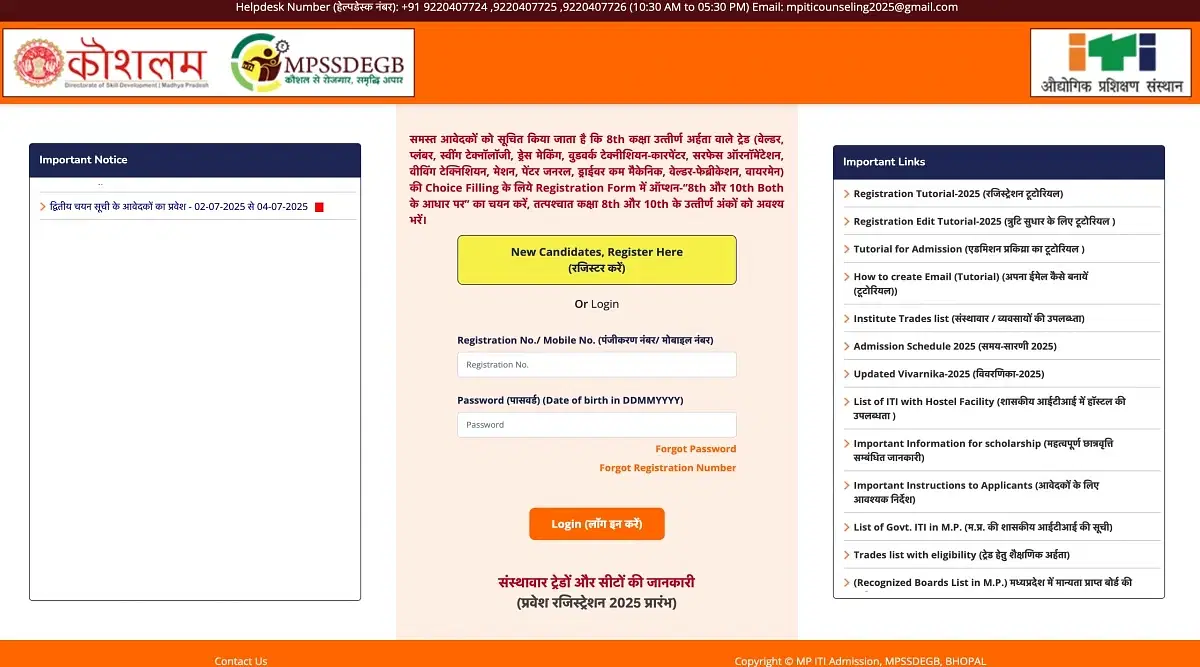

Master Degree in Accounting in Canada Admission Process

In Canada, master's in accounting admissions are based on the fulfillment of basic requirements, program-specific requirements, and eligibility criteria. Let us discuss different aspects of the admission process in detail.

Eligibility Criteria

This section elaborates on the eligibility criteria that one must meet in order to secure admission into the master of accounting and finance in Canada:

- Mandatory education of 10+2+4 years

- An aggregate percentage of 70-75% in the last two years of the bachelor’s degree program.

- It is compulsory to sit for GMAT or GRE exam to be able to apply to Canadian colleges and universities.

- For the prerequisite bachelor's courses, students must receive a minimum of 60% in order to demonstrate their knowledge of the field.

Admission Requirements

When it comes to admission requirements, applicants are required to submit certain documents along with their online applications. Moreover, international students need to showcase their proficiency in the English language by submitting ELP test scores.

Students can apply for master's in accounting programs through the official websites of the respective universities. Applicants must submit the following documents in order to apply for masters in accounting in Canada:

- Academic Transcripts

- 2-3 LORs

- Statement of Interest (include reasons for choosing the course and career goals)

- Resume (include educational and professional experience)

- MAcc Prerequisite Form (for students who studied from more than one institution at the UG level)

- Test Scores

Here are the university-specific minimum ELP score requirements for admission to MAcc programs:

| University | TOEFL iBT | IELTS | PTE | CAEL |

| York University | 100 | 7.0 | - | - |

| University of Saskatchewan | 97 | 6.5 | - | - |

| Carleton University | 86 | 6.5 | 60 | 70 |

| Brock University | 105 | 7.5 | 72 | - |

Why Study Masters in Accounting in Canada?

As there is a rise in demand for accounting professionals in Canadian multinational corporations, it is predicted that the admissions for master's degrees in accounting in Canada will increase by over 2% in the upcoming admission intakes. Let us look at some of the other benefits of pursuing a master of accounting and finance in Canada:

- Due to the high demand for accounting professionals in Canada, the Labour Force Survey (2017) predicts that the unemployment rate in the accounting sector will drop by 1.1 percent each year.

- There is a wide scope after pursuing masters in accounting in Canada as there is overall 10% growth in employment opportunities and satisfaction for people working in this field.

- Students pursuing a master of accounting and finance in Canada become proficient in areas like problem-solving and critical analysis.

- In Toronto, there are around 1,800 job vacancies for students holding MAcc degrees. This indicates that it is one of the booming sectors in Canada.

Cost of Pursuing Masters in Accounting in Canada

The cost for studying MAcc degree in Canada comes up to 43,000 USD per year (including all expenses). However, this cost also includes one-time expenses that students are not required to pay during the second year of study.

Pre-Arrival and Post-Arrival Costs

When applying for a masters in accounting in Canada, overseas applicants will incur the following pre-arrival and post-arrival expenses:

|

Expenses |

Cost (in USD) |

|

Pre-Arrival Expenses |

|

|

GRE Fee |

205 |

|

GMAT Fee |

599 |

|

TOEFL Fee |

160-250 |

|

IELTS Fee |

185-190 |

|

Application Fee |

68-113 |

|

Health Insurance |

401-607 |

|

Visa Application Fee |

235 |

|

Post-Arrival Expenses |

|

|

Airfare |

1,400 |

|

Hotel Accommodation |

200-800 |

|

Meals |

45 (per meal in a day) |

|

Travel |

25 (per day) |

|

Financial Statement |

10,000 |

Living Costs

Besides tuition fees, overseas students have to bear living expenses in Canada throughout their period of study. These expenses might differ from one student to another; however, we have given the estimated monthly costs of different living expenses in Canada below:

- Meal Plans: 7,600 USD (on an average)

- Transportation Expenses: 82 USD (U-Pass)

- Personal Expenses: 1,000 USD to 2,000 USD (approx.)

Annual Costs

Among the annual expenses are tuition fees, off-campus living costs, and expenses related to books and other educational supplies. While studying MAcc in Canada, international students will incur the following university-wise expenses per year:

|

University |

Tuition Fee (in USD) |

Living Expenses (in USD) |

Books and Educational expenses (in USD) |

|

40,550 |

10,900 |

570 |

|

|

35,700 |

4,380 |

1,150 |

|

|

33,370 |

10,550 |

905 |

|

|

29,000 |

14,310 |

760 |

Career Prospects Post Masters in Accounting in Canada

Masters in accounting in Canada is a highly rewarding program as it offers a number of lucrative career opportunities for international students. There are more than 3,873 job openings for accountants in Canada.

Moreover, the recruitment of accountants has increased by nearly 10% in several Canadian companies and government agencies. Further, accountants in financial services witnessed a 2% increase in hiring over those in legal services. Here are )some of the job opportunities and salaries one can expect after completing the master of accounting and finance in Canada:

- Management Accountant: 50,210 USD

- Government Accountant: 43,250 USD

- External Auditor: 41,400 USD

- Internal Auditor: 46,450 USD

- IT Auditor: 50,230 USD

POST YOUR COMMENT