Those who want to become a CFA, must have completed their bachelor's from any recognised university and completed the required work experience. Financial analyst, accountant, risk analyst, and chief financial officer are some jobs candidates can pursue after completing CFA.

How to Become a CFA?: To become a CFA, you must meet the eligibility criteria which require completion of graduation or in the final year of an undergraduate course in a relevant field. If not, you should at least have four years of working experience in the field of Finance and Management. In India, CFAs get paid nearly around 40-60 Lakhs Per Annum.

CFA stands for Chartered Financial Analyst. Choosing CFA as a career option is best suited for individuals who want to help organisations make the right financial decisions and also have a high earning potential. CFA exams are considered one of the toughest exams as it involves time, commitment and experience.

Who is a CFA?

A Chartered Financial Analyst is a professional designation accepted worldwide and offered by the CFA institute which was earlier known as the AIMR (Association for Investment Management and Research. This is considered a prestigious designation among finance professionals as the certification is offered based on measuring the competence and integrity of the financial analyst.

To become a CFA, you must pass three crucial exams, get a bachelor's degree and have at least four years of experience in the relevant field. Generally, CFAs apply their knowledge and skills in various roles related to finance and investment in an organization. They majorly play a key role in any financial decisions of the company.

Also Check: CFA Jobs, Scope, Salary in India

How to Become a CFA?

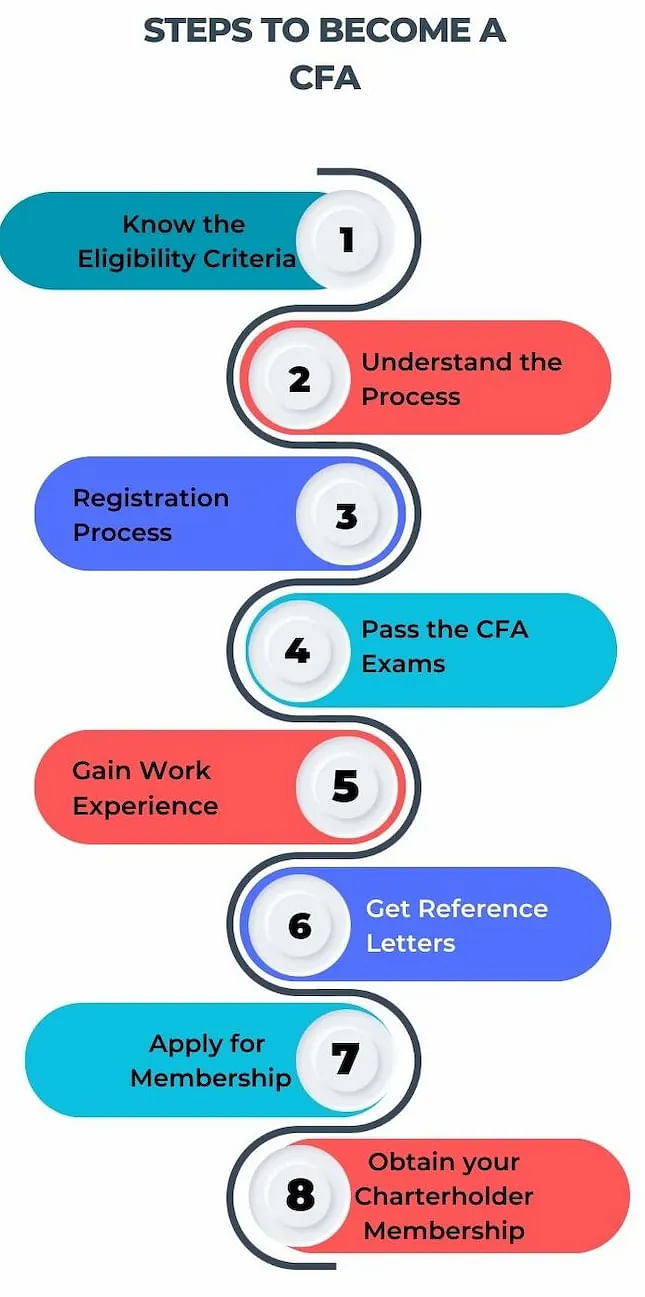

CFA is Chartered Financial Analyst. Are you wondering how to become a CFA and start your career as a Financial Analyst? Follow the steps below and get to know about the requirements and eligibility criteria to become a CFA.

Step 1: Know the Eligibility Criteria

To become a CFA, you must have either completed their bachelor's degree or in the final year of an undergraduate degree or acquired four years of working experience in the relevant field.

Step 2: Understand the Process

To become a certified Chartered Financial Analyst, you must clear three levels of exams and each level has a different format. You must understand the difficulty level and format of each level to plan and clear the exams accordingly.

Step 3: Registration Process

Once you are sure about the eligibility criteria and exam pattern, you can process the registration. The enrolment can be made through the CFA official website and a one-time payment needs to be made.

Please note that besides graduation and work experience, having an international passport is a prerequisite for enrolling on CFA exams.

Step 4: Pass the CFA Exams

The next step to becoming a CFA is passing three levels of exams covering the topic from different aspects of finance including economics, investment, portfolio management, cashflow management etc.

This is a computer-based exam covering multiple-choice questions. Generally, the CFA exams happen between different months for the three levels.

- Level 1 - Focuses on the development and implementation of Financial tools and maintaining professional values and ethics as a CFA. Level 1 exam will be conducted in the month of February, May, August and November

- Level 2 - This level focuses more on applying financial decisions in real-time corporate finance situations. The level 2 exams are conducted thrice a year in the month of May, August and November.

- Level 3 - Focuses more on portfolio management and compliance for an individual client or for an organization. Level 3 exams are conducted twice a year in February and August.

Step 5: Gain Work Experience

Gaining an “acceptable work experience” of 48 months in a field related to economics, finance and portfolio management. The candidate's work experience should have at least 50% role in the direct financial decisions of the company.

The work experience can be obtained before, during or after taking the exam.

Step 6: Start seeking Reference Letters

To apply for charter holder membership, you must submit referral letters which should mention their performance, work ethics and professional values. Reference letters from seniors or supervisors will add more credibility.

Step 7: Apply for Membership

Once you clear your exams and gain working experience as per norms, you can apply for CFA charter holder membership. The application will be approved by the CFA Institute after review.

Upon approval, you should maintain their membership by practising professional values and ethics.

What is the Role of a CFA?

In general, a Chartered Financial Analyst or a CFA is responsible for making sound decisions on how to spend the organization’s money to increase the profit through investment, stocks, new ventures or acquisitions.

You are also responsible for portfolio management and guidance in making any investment decisions for corporates or for an individual client.

CFAs are employed in various organizations including insurance firms, banks, corporate companies, government firms and even universities. They are responsible for implementing financial tools to analyse financial information. CFAs also play a pivotal role in planning the cash flows and assessing the company’s growth along with financial risk management.

Types of CFA Roles

Since CFA is one of the most respected and highly in-demand designations across the corporate and finance world, you are employed under different designations starting from fresher to senior management roles. Following are some of the job roles a certified financial analyst may have

- Financial Analyst

- Risk Analyst

- Portfolio managers

- Accountant

- Chief Finance Officer

- Financial Advisor

- Research Analyst

- Investment Officer

Also Check: CFA Vs MBA

Jobs and Salaries for CFA

The salary range of a CFA ranges between 20 Lakhs to 80 Lakhs per annum based on the level they have passed in the CFA exams and the designation. The following analysis by payscale will give you an idea about the CFA salary in India

| Job Title | Range | Average |

| Financial Analyst | ₹299K - ₹1M | ₹603,882 |

| Chartered Financial Analyst | ₹296K - ₹2M | ₹661,900 |

| Research Analyst | ₹383K - ₹2M | ₹780,732 |

| Finance Manager | ₹674K - ₹3M | ₹1,449,117 |

| Investment Banker | ₹228K - ₹4M | ₹1,017,365 |

| Senior Financial Analyst | ₹507K - ₹2M | ₹1,137,175 |

Top Companies Recruiting for CFA Roles

Following are the companies recruiting CFAs for various roles and designations in India and Worldwide. The job vacancy is posted through various recruitment websites.

| Recruiters | Salary (In Lakhs Per Annum) |

| The Goldman Sachs Group | Rs. 3,00,000 – 25,00,000 |

| Morgan Stanley | Rs. 4,00,000 – 30,00,000 |

| J.P Morgan | Rs. 5,00,000 – 40,00,000 |

| Crisil | Rs. 4,00,000 – 25,00,000 |

| Credit Suisse | Rs. 10,00,000 – 40,00,000 |

Also Check: CFA Vs CA

Subjects Covered in CFA Program

You must now be clear on how to become a CFA. Let us now gain an understanding of the subjects involved in the CFA course. There are three levels to the CFA course that includes various subjects at each level. Here are the subjects along with their weightage.

| Subject | Weightage by % | ||

| Level I | Level II | Level III | |

| Ethical and Professional Standards | 15-20 | 10-15 | 10-15 |

| Quantitative Methods | 8-12 | 5-10 | - |

| Economics | 8-12 | 5-10 | 5-10 |

| Financial Reporting and Analysis | 13-17 | 10-15 | - |

| Corporate Finance | 8-12 | 5-10 | - |

| Equity Investments | 10-12 | 10-15 | 10-15 |

| Fixed Income | 10-12 | 10-15 | 15-20 |

| Derivatives | 5-8 | 5-10 | 5-10 |

| Alternative Investments | 5-8 | 5-10 | 5-10 |

| Portfolio and Wealth Management | 5-8 | 10-15 | 35-40 |

Though subjects remain unchanged across all three levels of CFA, there is a variation in the weightage.

CFA Exam Pattern

Knowing the CFA paper structure is essential for those who wish to become a CFA. Refer to the table below to learn about the CFA exam pattern.

| Particulars | Details |

| Mode of Conduct | Online |

| Exam Duration | Level 1: 2 sessions of 135 minutes each with an optional break |

| Level 2: 4 hours & 24 minutes with an optional break | |

| Level 3: Duration is same as Level 2 | |

| Types of Questions | Level 1: MCQs |

| Level 2: Vignette-supported MCQs | |

| Level 3: Vignette-supported MCQs & essay questions | |

| Number of Questions | Level 1: 180 MCQs |

| Level 2: 88 Vignette-supported MCQs | |

| Level 3: 8-11 Vignettes followed by 44 MCQs and essay-based questions |

Benefits of Becoming a CFA

A CFA enjoys certain benefits after the course is complete. Listed below are some of the perks of becoming a CFA.

- Enhanced Career Opportunities: CFA roles have high demand in the job market and can grow exponentially in your career. Investment banking, portfolio management, research, and consulting are popular career options.

- Global Recognition: It is a globally recognised certification and can get you many opportunities worldwide. It will also help gather diverse experiences, exposure to different cultures, and the chance to unite with professionals worldwide.

- High-Paying Roles: CFA candidates often enjoy pleasing salary packages. The specialised skills and expertise gained through a CFA program can usher to higher earning possibilities.

- Networking and Professional Connections: CFA courses often provide prospects to network with professionals, industry experts, and fellow students.

Building a strong network during your studies can lead to valuable connections, collaborations, and job opportunities. - Personal Fulfillment: Pursuing a CFA can contribute to your growth and intellectual development. It challenges you to think critically, solve difficult problems, and analyse new possibilities.

CFA Exam Preparation Tips

Preparing for an exam like CFA requires a lot of hard work and dedication. Here are some tips that aspiring students should follow to prepare effectively for CFA exams.

- Gain clarity on the exam format for various levels of CFA.

- Prepare a study schedule based on the CFA syllabus and follow it religiously.

- Use study materials offered by the CFA Institute.

- Practice well through mock tests, practice questions, and more.

- Take assistance from a coaching institute or join online study groups if required.

Also Check: CFA Syllabus and Subjects

-

CFA stands for Chartered Financial Analyst. -

Requires passing three levels of exams. -

Needs 48 months of acceptable work experience. -

Salaries in India range ₹20L to ₹80L PA.