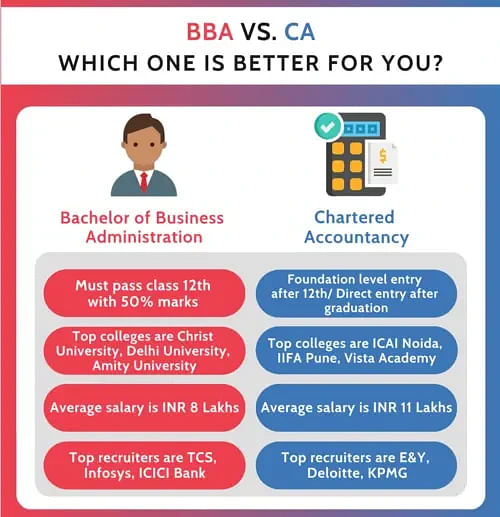

BBA and CA are two different study courses; the BBA program is designed to keep focus on business, management, and entrepreneurship, whereas CA is entirely based on taxation, auditing, and accounts.

Table of Contents

BBA vs CA: BBA is a bachelor of business administration aimed at fostering managerial and entrepreneurial skills whereas CA is a professional course that develops accounting auditing, assessment, and taxation skills among the candidates.

Both these courses are the most popular choices among the students after their Intermediate.

What is BBA?

BBA is a Bachelor of Business Administration and comprises multiple fields like business management and administration, which fosters managerial and entrepreneurial skills. After completion of the course, the salary offered to you heavily depends upon your skills, knowledge, and experience.

Top BBA specializations are:

- BBA in Human Resource Management

- BBA in Marketing

- BBA in Sports Management

- BBA in Management

- BBA in Hospital & Healthcare

- BBA in Accounting

- BBA in Supply Chain

- BBA in Retail

Also Read: BBA Subjects 2025

What is CA?

CA is a professional practice of accounting, auditing, taxation, and financial assessment for an individual or an organization. An accounting expert certified by a statutory body as competent to handle the accounting and taxation of a business enterprise is awarded the designation of a chartered accountant.

Examinations during the Chartered Accountancy course are:

- CA Foundation Examination (earlier known as Common Proficiency Test or CPT)

- CA Intermediate (Integrated Professional Competence or IPC) Examination

- CA Final Examination

Also Read: CA (Chartered Accountancy) Syllabus and Subjects

Key Differences of BBA vs CA

The critical differences between BBA and CA courses on different parameters like eligibility criteria, skills required, top recruiters, career opportunities, and average package are tabulated below in detail for students' understanding:

| Parameters | BBA | CA |

| Full Form | Bachelor of Business Administration | Chartered Accountancy |

| Eligibility Criteria | Passed Intermediate with 50% | Foundation Route: After Class 12 Direct Entry Route: Graduation |

| Skills Required | Network Security, Data Mining, Operation Research, Cyber Security, Cyber Laws, Data Structure | Audit, Taxation, Banking, Finance, Management |

| Top Recruiters | Infosys, ICICI Bank, Intel, Wipro | E&Y, Deloitte, Olam International, KPMG |

Also Read: BBA Admission 2025

Top Colleges for BBA vs CA with Fees

Top colleges to pursue the BBA and CA course with the average program fees is tabulated below separately for students:

Top Colleges for BBA with Fees

The top colleges for BBA courses are Christ University, Delhi University, Presidency College Bengaluru, and Amity University Noida, and the average program fees of the colleges are tabulated below

| Top Colleges | Average Program Fees |

| Christ University, Bengaluru | INR 1.80 LPA |

| Symbiosis Institute of Computer Studies and Research, Pune | INR 4 LPA |

| Delhi University, New Delhi | INR 75,000 |

| Presidency College, Bengaluru | INR 4.50 LPA |

| Amity University Noida | INR 6 LPA |

Also Check: Top BBA Colleges in India 2025

Top Colleges for CA with Fees

The top colleges for CA courses are ICAI Noida, IIFA Pune, Zell Education Mumbai, and Vista Academy Dehradun and the course fees are tabulated below with their fees:

| Top Colleges | Average Program Fees |

| The Institute of Chartered Accountants of India (ICAI), Noida | INR 25,000 |

| Indian Institute of Finance and Accounts, Pune | INR 2.34 LPA |

| Pearn Accountants, International Accountants and Business Consultants, Kochi | INR 54,000 |

| Zell Education Mumbai | INR 3 LPA |

| Vista Academy, Dehradun | INR 32,500 |

Career Scope of BBA Course

The careers scope of the BBA course is coating analyst, Web designer and web developer software developer, software tester, automation testing, and the average salary of each of them are tabulated below.

| Job Roles | Average Salary |

| Coding Analyst | INR 8 LPA |

| Web Developer | INR 7 LPA |

| Software Developer | INR 7 LPA |

| Web Designer | INR 8 LPA |

| Software Tester | INR 10 LPA |

| Automation Testing | INR 7 LPA |

Also Read: BBA Salary, Jobs, Scope, Placements in India

Career Scope of CA Course

The career options after completing CA courses are chartered accountant, financial controller, tax accountant, chief financial officer, auditor, and accounts clerk; the average salary of each is tabulated below.

| Job Roles | Average Salary |

| Chartered Accountant | INR 10 LPA |

| Financial Controller | INR 11 LPA |

| Tax Accountant | INR 9 LPA |

| Chief Financial Officer | INR 20 LPA |

| Auditor | INR 8 LPA |

| Accounts Clerk | INR 9 LPA |

Top Recruiters for BBA vs CA Course

The top recruiters of the BBA course and CA course are tabulated below, and they are TCS, Deloitte ICICI Bank, KPMG, Wipro, Everest Enterprises, Tolaram group, etc:

| Top Recruiters of BBA Course | Top Recruiters of CA Course |

| TCS | E&Y |

| Infosys | Deloitte |

| ICICI Bank | Olam International |

| Intel | KPMG |

| Wipro | PwC |

| Everest Enterprises | Tolaram Group |

| Meghana Apparel Industry | Landmark Group |

| Ushta Te HR Consultancy | ETA Ascon Group |

| HDFC Bank | Axis Bank |

| Hugel Trading Solution | Kotak Mahindra |

BBA vs CA: Which Course Is Better?

BBA is a management course, whereas chartered accountancy is a financial certification course, and both these courses offer higher education studies and lucrative job opportunities. When deciding which course is better, there are multiple factors that students must consider. Students must examine the options available after the course duration of the course skills developed after the course area of interest focus of the course. Both courses have different skills, so deciding which course is better depends upon the student's interest.

How to Choose Between BBA and CA?

While deciding which career path or course will be better, we need to consider a few crucial factors, such as the duration of the study, the focus of the study, career options available after completing the course skill development, and the area of interest. These essential factors are explained below for a better understanding.

- Duration of the course: The time of a BBA program is generally 3 years, and further completion of the CA course typically takes 4 to 5 years.

- The focus of the course: The prime focus of the BBA program is to equip students with the skills of management marketing entrepreneurship, whereas the direction of the CA program is to teach students skills in accounting auditing, taxation, and financial management.

- Career options: The career options available after BBA are automation testing, Web design, web development, software tester coating analysis, and software development. In comparison, options after the CA course are chartered accountant, tax accountant, chief financial officer, auditor, etc.

- Area of interest: The personal area of interest of the student is significant because one must analyze their interest. Suppose the candidate is interested in marketing management business analysis. In that case, they must offer a BBA course, while if they are interested in taxation auditing finances, they can pursue a chartered accountancy.

POST YOUR COMMENT