Download Plus One Accountancy notes in a PDF file format. Explore chapters and Accountancy formulas and some essential tips to score good marks.

Table of Contents

Accountancy is considered a major subject when students choose commerce as their stream in plus one. It helps students in enhancing their analytical and logical thinking. Students can view the chapter-wise notes of all the units, prepare for their exams efficiently, and revise the questions provided at the end of each chapter of the plus one accountancy notes to score well.

Accountancy or Accounting is a structure for assessing commercial activities, converting information into reports, and making the findings available to decision-makers. Financial statements are the records that link these conclusions regarding an organization's financial performance. Moreover, Accounting is known as the "language of business." All these are covered in Plus One Accountancy Notes here.

Plus one students are urged to memorize and revise their Plus One Accountancy notes completely and regularly to understand its chapters better. Students can prepare better and score well in their exams by downloading these notes and formulas as a PDF file provided in this article. Aside from being a way to predict future financial changes, Accountancy as a subject can also be used to examine alternative business scopes and evaluate business prospects.

Plus One Accountancy Notes

Students can go through the notes while revising for their exams. The notes are written in easy language, which will help students understand it better. Students need to note that the revision notes are meant to be used only as a revision source after studying from the textbooks and classroom notes:

|

Download Plus One Accountancy Notes PDF |

Chapters of Plus One Accountancy

Students must be aware of the chapters before the beginning of the academic session, and it will help students understand the concepts taught inside the classroom quickly. Therefore, we have provided all the plus one Accountancy chapters for your convenience:

Accountancy Part 1

Here are the list of chapters taught in Plus One Accountancy Part 1:

|

Chapter No. |

Chapter Name |

|

Chapter 1 |

Introduction to Accounting |

|

Chapter 2 |

Theory Base of Accounting |

|

Chapter 3 |

Recording of Transactions – I |

|

Chapter 4 |

Recording of Transactions – II |

|

Chapter 5 |

Bank Reconciliation Statement |

|

Chapter 6 |

Trial Balance and Rectification of Errors |

|

Chapter 7 |

Depreciation, Provisions and Reserves |

|

Chapter 8 |

Bill of Exchange |

Accountancy Part 2

Here are the list of chapters taught in Plus One Accountancy Part 2:

|

Chapter No. |

Chapter Name |

|

Chapter 9 |

Financial Statements – I |

|

Chapter 10 |

Financial Statements – II |

|

Chapter 11 |

Accounts from Incomplete Records |

|

Chapter 12 |

Applications of Computers in Accounting |

|

Chapter 13 |

Computerised Accounting System |

Important Plus One Accountancy Formulas

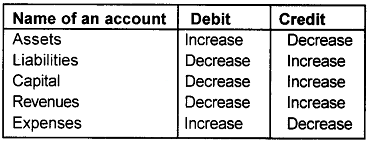

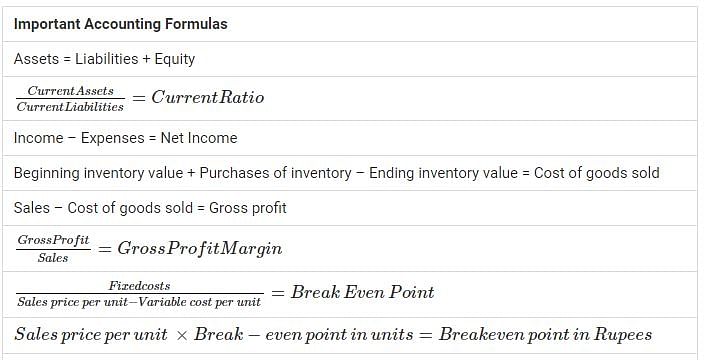

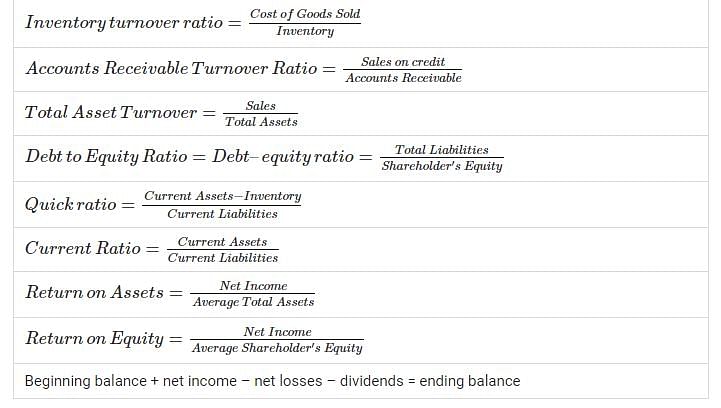

There are several accounting formulas used to calculate all financial transactions. These formulas are used to create the income statement, partnership, balance sheet, etc. Make a point to go through these formulas twice a day to learn them by heart. Once you are familiar with the formulas, you will quickly solve all the plus one accountancy illustrations:

-

Formula 1: The Accounting Equation

The accounting equation is a vital formula. For it is the root of accounting.

Worth = Assets – Liabilities

-

Formula 2: Current Assets

Current assets are the sum of assets that will convert into cash in less than 12 months.

Current Assets = Cash + Accounts Receivable + Inventory + Prepaid Expenses

-

Formula 3: Net Fixed Assets

Net fixed assets are the book value of fixed assets.

Net Fixed Assets = Fixed Assets @ cost – Accumulated Depreciation

-

Formula 4: Total Assets

The sum of all assets

Total Assets = Current Assets + Other Assets + Net Fixed Assets

-

Formula 5: Current Liabilities

Bills due within 12 months of the Balance Sheet date.

Current Liabilities = Accounts Payable + Accrued Expenses + Current Portion of Debt + Income

Taxes Payable

-

Formula 6: Shareholder’s Equity

Shareholder’s equity is the value of the company to its owners. Also called net worth.

Shareholder’s Equity = Capital Stock + Retained Earnings

-

Formula 7: Total Liabilities & Equity

This is the total obligation plus worth of the entity.

Total Liabilities & Equity = Current Liabilities + Long-Term Debt + Shareholders’ Equity

The next accounting formulas are needed to produce the Income Statement.

-

Formula 8: Gross Margin

The left over amount after cost of goods sold are taken away from net sales.

Gross Margin = Net Sales – Cost of Goods Sold

-

Formula 9: Operating Expenses

The sum of expenses paid for developing and selling the product or service.

Operating Expenses = Sales & Marketing + Research & Development + General &

Administrative

-

Formula 10: Income From Operations

Net profit from the product or services sold.

Income From Operations = Gross Margin – Operating Expenses

-

Formula 11: Net Income

Net income is all income minus total expenses and costs.

Net Income = Income From Operations + Interest Income – Income Taxes

Tips to Score Good Marks in Plus One Accountancy

To score good marks in the plus one Accountancy exam, you must consider a few points. It will help you score good marks in your exam. Some of the tips and tricks to score good marks in your exam are:

-

Read the question paper carefully in the first 15 minutes.

-

Highlight the answer.

-

Answer in steps and keep your writing neat.

-

Show proper working notes.

-

Don't mix the rough work with the answers.

-

Leave a gap of 2-3 lines between every solution.

-

Please read the questions twice before attempting them.

Read More on Kerala Board

POST YOUR COMMENT