Table of Contents

CFA Books 2025 consist of study materials for the CFA exam level 1, 2, and 3. CFA books include Schweser Notes by Kaplan Schweser, CFA Books by Wiley, CFA Institute Publications and so on. These books are a comprehensive source to understand the CFA syllabus, CFA exam pattern, and essential topics in the exam.

Choosing the right CFA books is essential to crack the CFA exam. There are many factors that candidates must keep in mind while using the books mentioned on this page. The sections below include significant CFA level 1 books, including level 2 and level 3.

CFA Books 2025

CFA books PDF will provide candidates practical tools to prepare for the CFA exam. Students are advised to familiarise themselves with the syllabus and CFA exam pattern using the CFA exam preparation books.

The best CFA exam preparation books chosen are based on the structure of the syllabus, the questions that are asked, and how thorough they are with their content. The materials should be curated based on the student’s needs.

A list of the best CFA books has been prepared below for potential students to boost their preparation.

Must Read: How to Become a CFA?

CFA Level 1 Books 2025

The CFA exam 2025 for level 1 conducts 2 sessions of 2 hours and 15 minutes each. The first session comprises 90 objective-type (MCQ) questions for students to answer. The overlying theme for Session 1 is economics, quantitative aptitude, alternate investments, and equity, while Session 2 deals with wealth management, portfolio management, derivatives, etc.

Here is a comprehensive list of CFA level 1 books, including the author and subject they cover. Students can also find the CFA level 1 books PDF online for rent or sale.

| Book Name | Subject | Author |

| SchweserNotes | All | Kaplan Schweser |

| Wiley CFA 11th Hour Review and Test Bank | All | Ela Guides |

| Wiley CFA Level 1 Book | All | Wiley |

| Economics for Investment Decision Makers | Economics | Christopher D. Piros |

| Financial Reporting and Analysis: Using Financial Accouting Information | Financial Reporting Analysis | Charles H. Gibson |

| Equity Asset Evaluation | Equity Investments | Gerald E. Pinto |

| The New Wealth Management: The Financial Advisor's Guide to Managing and Investing Client Assets | Portfolio Management and Wealth Planning | Harold Evensky, Stephen M. Moran |

| Options, Futures, and Other Derivatives | Derivatives | John C. Hull |

| Fixed Income Analysis | Fixed Income | Barbara S. Petitt |

How to Study CFA Level 1 Books 2025?

Candidates must remember a few simple pointers while preparing for the CFA level 1 exam. These include the optimum way to use the best books for CFA level 1.

- Keep revising each foundational topic as it gets completed. This will ensure the basic concepts are embedded and understood well.

- Solve practice papers and mock tests to get a sense of the actual exam setting, the time constraints and the question paper pattern.

- Understanding the basis behind concepts instead of rote memorisation will help to tackle the essential topics in level 2 and 3 exam.

- Reading through the official CFA institute curriculum will provide more options for CFA level 1 books PDF.

Also Read: How Hard Is the CFA Exam?

CFA Level 2 Books 2025

The CFA level 2 books explain the level 1 concepts, except they are applied to real-time situations. These include analysing complex financial data related to equity, derivatives, portfolio management, etc. Hence, they can also be used to study the level 2 syllabus.

The CFA level 2 exam consists of 2 sessions for 2 hours and 12 minutes. It is known to be the most difficult of all the exam levels.

Below is the list of CFA books for level 2 with the author's name and subject. There are also many sites to download the CFA level 2 books for free, buying or renting them online.

| Book Name | Subject | Author |

| Schweser Notes | All | Kaplan Schweser |

| Wiley CFA Level 2 Books | All | Wiley |

| CFA Program Curriculum Level 2 Vol 1-6 | All | CFA Institute |

| Quantitative Investment Analysis | Quantitative Methods | Richard A. DeFusco |

| Equity Asset Evaluation | Equity Investments | Gerald E. Pinto |

| Ethics and Professional Standards | Ethical and professional standards | Bidhan L. Parmar |

| Alternative Investments: CAIA level 1 | Alternative Investments | D. R. Chambers |

| Options, Futures, and Other Derivatives | Derivatives | John C. Hull |

| Fixed Income Analysis | Fixed Income | Barbara S. Petitt |

How to Study CFA Level 2 Books 2025?

Following the below-mentioned points will boost the candidate’s preparation for the CFA exam 2025. Since CFA level 2 is difficult, students should observe these tips to ace the CFA exam and proceed to level 3.

- Start preparation for CFA level 2 at least 6 months before the exam.

- The CFA exam has no negative marking, hence students must attempt all the questions.

- To solve numerical-based questions of level 2, formulas and equations should be memorised properly.

- Since CFA level 2 exam is the most difficult, with the highest materials to cover, students should try to get as many reading materials as possible.

- Students must aim for a minimum of 350 hours of study time specifically for the CFA level 2 exam.

- Understand vignette-type questions (mini case studies) asked in the exam and its format.

- Students can also refer to full-length YouTube tutorials to understand complex concepts of CFA level 2 curriculum.

CFA Level 3 Books 2025

The final level of CFA examination 2025 requires students to study level 1 and 2 concepts. These concepts must be applied in wealth planning and portfolio management situations. The CFA level 3 exam is held in 2 sessions of 2 hours and 12 minutes each. Candidates are allowed to take a break if necessary.

Listed below are the CFA level 3 books for students’ reference.

| Book Name | Subject | Author |

| Institutional Portfolio Management | Institutional Investors | E. Philip Davis |

| Ethical and Professional Standards and Behavioural Finance | Ethical and Professional Standards | Kaplan Schweser |

| Behavioural Investment Management: An Efficient Alternative to Modern Portfolio Theory | Behavioural Finance and Investment Decision Making | Arnaud de Servigny, Greg Davies |

| Quantitative Investment Analysis | Quantitative Methods | Richard A. DeFusco |

| Equity Asset Evaluation | Equity Investments | Gerald E. Pinto |

| Private Wealth Management: The Complete Reference for the Personal Financial Planner | Private Wealth Management | G Victor Hallman, Jerry Rosenbloom |

| Risk Management and Monitoring | Risk Management | Greg Shields |

| Investment Management: A Science to Teach or an Art to Learn? | Execution of Portfolio Decisions | Frank J. Fabozzi |

| Performance Evaluation and Attribution of Security Portfolios | Evaluation and Attribution | Bernard R. Fischer, Russell Wermers |

How to Study CFA Level 3 Books 2025 ?

To enhance the preparation strategy, students must follow the listed measures properly.

- CFA level 3 exam requires students to answer essay-type questions. Thus, attempting lengthy questions as such takes efficient time management skills.

- To understand the content of CFA level 3 books, students must revise level 1 and level 2 books for the basic concepts.

- Combine 3rd party materials with the CFA Institute curriculum for a comprehensive view of the exam preparation requirements.

- Students must use tools such as mnemonic devices or flashcards to remember important formulas and equations for item-set questions.

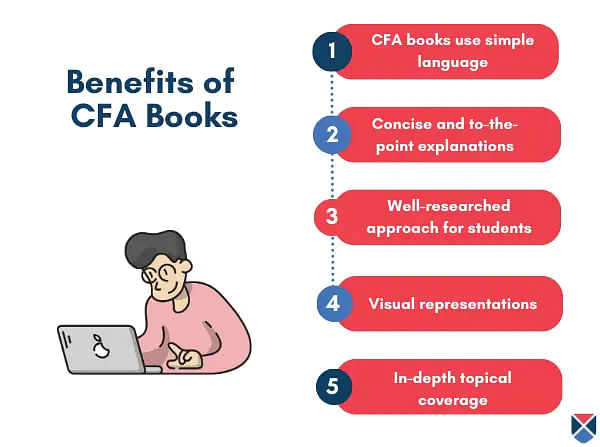

Benefits of CFA Books 2025

A few aspects students can benefit from are listed below while going through the CFA level 1 books, including levels 2 and 3.

- CFA books are legible and use simple language for candidates to read and comprehend quickly.

- CFA books PDF for levels 1, 2, and 3 have concise and to-the-point explanations due to the vastness of the curriculum.

- The CFA exam preparation books use a well-researched approach to the syllabus contents to help students.

- Many diagrams and visual representations are depicted in the book. It aids students in visually understanding the concepts well.

- The CFA level 3 books above cover all the critical topics in depth. It ensures that no subject is left behind and the students are covered syllabus-wise.

FAQs on CFA Books

Q: Which CFA books are best for basic quantitative methods?

Candidates can study from the Schweser books, Wiley books, or Quantitative Investment Analysis by Richard A. DeFusco.

Q: Which CFA level 2 books should be studied for Fixed Income Analysis?

Candidates can study the CFA book Fixed Income Analysis by Barbara S. Petitt to understand basic quantitative aptitude concepts.

Q: What CFA level 3 books can be studied to clear the level 3 exam?

Candidates must keep note of books such as Risk Management and Monitoring by Greg Shields, Performance Evaluation and Attribution of Security Portfolios by Bernard R. Fischer and Russell Wermers, Institutional Performance Management by E. Philip Davis, among many more.

Q: What are the benefits of studying from CFA books PDF and materials?

The benefits of studying from these books are clarity of concept, visual aids, extensive and in-depth coverage of important topics, concise and relevant points, etc.

Q: Do candidats need to buy other books if they already have CFA books by Schweser?

As SchweserNotes and Wiley Guides cover all the important CFA subjects extensively in several editions, students need to mosly solve the mock tests and sample papers to prepare for the CFA exam. However, if not available the books mentioned above can also help greatly.

![Christ University Entrance Test [CUET]](https://media.getmyuni.com/assets/images/main/exam/cuet.png)