MBA in Banking and Finance: Course Details, Eligibility, Admission, Fees

MBA in Banking and Finance is a two-year postgraduate course that offers an in-depth study of banking management along with insights into finance and operation management. Students also gain practical insight into analyzing financial data, effectively managing financial resources, and making informed investment decisions through internships and projects.

MBA Banking and Finance Admission 2023 requires candidates to clear their bachelor's degree with a minimum of 50% marks or unreserved and 45% for SC/ST/PwD category from an accredited university. Apart from the merit score, the candidate also needs to qualify for the entrance exams such as GMAT, CAT, SNAP, etc. The average MBA in Banking and Finance fees is in the range of INR 35,000-5 LPA.

Table of Contents

- What is an MBA in Banking and Finance Course?

- MBA in Banking and Finance Eligibility Criteria

- Why Choose an MBA in Banking and Finance Course?

- MBA in Banking and Finance Admission 2023

- MBA in Banking and Finance Entrance Exams

- Top MBA in Banking and Finance Colleges in India with Fee Details

- MBA in Banking and Finance Cutoff for Top Colleges

- Types of MBA in Banking and Finance Courses

- MBA in Banking and Finance Syllabus and Subjects

- MBA in Banking and Finance vs MBA in Finance

- Courses After MBA in Banking and Finance

- Salary of an MBA in Banking and Finance in India

- Career Options After Master of Business Administration in Banking and Finance Course

- MBA in Banking and Finance Scholarships

- Skills to Excel as an MBA in Banking and Finance Graduate

MBA in Banking and Finance Course Details

| Degree | Masters |

| Full Form | Master of Business Administration in Banking and Finance |

| Duration | 2 Years |

| Age | No specific age limit |

| Subjects Required | Any discipline |

| Minimum Percentage | A minimum of 50% marks in Bachelor's Degree for unreserved category and 45% for reserved categories. |

| Average Fees | ₹80K - 24 LPA |

| Average Salary | INR 4-12 LPA |

| Employment Roles | Financial Analyst, Finance Associate, Finance Senior Analyst, Bank Manager, etc. |

| Top Recruiters | HDFC Bank, Muthoot Finance, IndusInd Bank, S&P Global, etc. |

What is an MBA in Banking and Finance Course?

The MBA in Banking and Finance falls under the umbrella of MBA courses and focuses on financial management, corporate finance, and aspects of international finance. The important MBA Banking and Finance subjects include marketing management, mutual fund management, corporate communication, strategic management, etc.

After completion of the MBA in Banking and Finance course, graduates can work in commercial banking, risk management, academia, research, etc. The average MBA Banking and Finance salary ranges between INR 4-12 LPA (Source: Payscale).

MBA in Banking and Finance Eligibility Criteria

The MBA in Banking and Finance admission process depends on its eligibility criteria, which vary from one university to another based on student intake, reputation, and ranking. Below are the standard parameters followed for admission to the course.

- Candidates are required to have a bachelor's degree in BCom, BBA, or any equivalent degree with a minimum of 50% marks for unreserved category and 45% for SC/ST/OBC category students. The candidate needs to qualify for entrance exams such as CAT, XAT, SNAP, etc.

- There are various colleges that accept GMAT scores ranging between 500-700.

- There is no specific age restriction for an MBA, but some exams, like ATMA, do have a minimum age criteria of 21 years at the time of application.

Why Choose an MBA in Banking and Finance Course?

The demand for MBA in Banking and Finance graduates in various sectors is high, such as the government and private sectors, public accounting firms, budget planning, market research, consultancies, and corporations. Below listed are some detailed reasons why one should choose the MBA Banking and Finance course:

- The course offers students advanced knowledge about different investment strategies, insurance, and corporate risks involved in the banking and finance sector.

- As per recent reports, the global banking service market is projected to grow at a CAGR of 17.1% by the year 2030.

- The Finance sector globally is expected to have a high growth rate and employment, with a CAGR of 14.7% expected till 2027.

- Students with expertise in the finance domain will witness more jobs as the expected employment growth rate is 7% between the years 2021-31. (As per BLS)

- Graduates get the opportunity to work in prestigious banks such as Citibank, HSBC, Bank of America, etc.

Also, Read: Why MBA? Top Reasons to Pursue an MBA

MBA in Banking and Finance Admission 2023

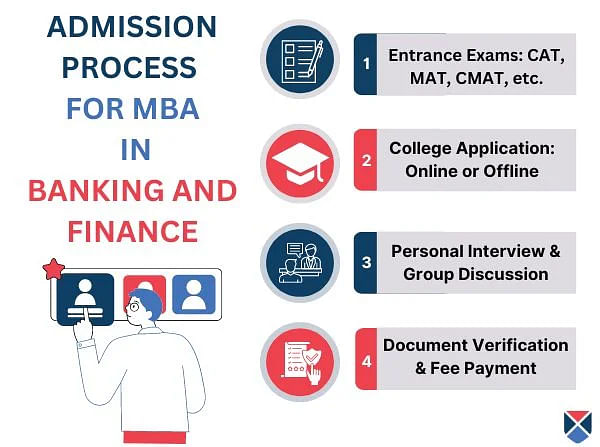

The admission procedure for the MBA in Banking and Finance course is based on merit and entrance exam scores of CAT, MAT, etc. Most of the colleges in India follow a standard procedure for admission to the MBA Banking and Finance course:

- Step 1: The candidate needs to clear the entrance exam cut-off declared by the college.

- Step 2: Students can apply online through the college website and submit the required documents. However, students can visit the college admission desk for offline admission.

- Step 3: Candidates will be selected for further process based on their eligibility requirements and qualifying cut-off scores for the entrance exams.

- Step 4: Candidates may have to appear for personal interview sessions and group discussions for final selection.

- Step 5: Shortlisted students must finish the documentation process and pay the admission fees.

Read More on MBA Admission Process

MBA in Banking and Finance Entrance Exams

The aspirants have to appear for the entrance examinations, which are held all across the country. Universities like Sharda University also conduct their own entrance exam known as SUAT for the selection process. The aspirant will be tested based on critical and analytical thinking. Listed below are some of the important examinations for the MBA Banking and Finance course:

|

MBA Banking and Finance Entrance Exams |

Registration Date |

Accepting Colleges |

| Nov 24, 2024 |

Utkal University, RIMT, Jain University, SRM Institute of Management, Amity University, Parul University |

|

| Feb 25- Dec 17, 2023 |

RIMT, Jain University, SRM Institute of Management, Amity University, Parul University |

|

| Jan 7, 2024 |

RIMT, Jain University, SRM Institute of Management |

|

|

Symbiosis School of Banking and Finance |

||

| Jan 22, 2024 |

RIMT, Jain University, SRM Institute of Management, Parul University |

Top MBA in Banking and Finance Colleges in India with Fee Details

MBA in Banking and Finance courses are being provided by several private colleges across the country such as Manipal Academy of BFSI, Sharda University, Symbiosis School of Banking and Finance, etc. The average MBA in Banking and Finance course ranges between INR 35,000-5 LPA.

Admission to the top MBA in Banking and Finance colleges in India is subject to cut-off marks in MBA entrance exams. The following are the best colleges for an MBA in Banking and Finance in India, along with their average course fees.

|

Colleges |

Average Fees |

Admission Fees |

Miscellaneous Fees |

|

INR 75,000-1.25 LPA |

INR 2,300 |

- |

|

|

INR 36,000 PA |

INR 600 |

INR 3,600 PA |

|

|

INR 1.44 LPA |

INR 12,000 |

INR 5,000 PA |

|

|

INR 2.5 LPA |

- |

- |

|

|

INR 4.03 LPA |

INR 20,000 |

- |

|

|

INR 4 LPA |

INR 25,000 |

INR 8,000 PA |

|

|

INR 75,000 PA |

INR 14,800 |

- |

|

|

INR 2.04 LPA |

- |

- |

|

|

INR 1.47 LPA |

INR 10,000 |

- |

|

|

INR 3.5 LPA |

INR 20,000 |

INR 5,000 |

City-Wise Top MBA in Banking and Finance Colleges

|

Top Cities |

Average Fees |

| INR 5 LPA | |

| INR 4.9 LPA | |

| INR 9.1 LPA | |

| INR 8.5 LPA | |

| INR 3.5 LPA | |

| INR 9.6 LPA | |

| INR 3.2 LPA | |

| INR 1.3 LPA |

MBA in Banking and Finance Cutoff for Top Colleges

MBA in Banking and Finance entrance exams vary as per the number of applicants, the difficulty level of the exam, etc. Below is the expected 2023 cutoff for colleges offering an MBA in Banking and Finance course:

|

Name of the College |

Expected Entrance Exam Cutoff 2023 (Percentile) |

|

Symbiosis Institute of Banking and Finance |

65+Percentile |

|

Sharda University |

70+Percentile |

|

Manipal Academy of BFSI |

75+Percentile |

|

Jain University |

72+Percentile |

Types of MBA in Banking and Finance Courses

MBA in Banking and Finance courses can be pursued in full-time, part-time, or distance modes. Eligibility differs according to the mode of education selected. Below listed are MBA in Finance and Banking course details:

|

Types |

MBA Finance and Banking Eligibility |

Duration |

|

Full-Time MBA Banking and Finance |

Bachelor's degree with a minimum of 50-55% aggregate for unreserved category students and 45-50% for reserved category students + Entrance Examination Score+ GD/PI/WAT Score |

2 Years |

|

Part-Time MBA Banking and Finance |

Bachelor's degree with 50-55% with a minimum of aggregate for unreserved category students and 45-50% for reserved category students |

2-3 Years |

|

Distance MBA Banking and Finance |

Bachelor's degree with 50% with a minimum of aggregate for unreserved category students and 45% for reserved category |

2-4 Years |

Part-Time MBA in Banking & Finance Course

Below mentioned are part-time MBA in Banking and Finance course details:

- Part-time MBA in Banking and Finance is ideal for working professionals who want to enhance their domain knowledge in the finance and banking sectors.

- The course can be pursued at colleges like KIIT University, TAPMI Online College, etc.

- The average part-time MBA Banking and Finance fee is in the range of INR 75,000-2 LPA.

Distance MBA in Banking and Finance Course

Below are the distance MBA in Banking and Finance course details:

- The duration of a Distance MBA in Banking and Finance is 2-4 years.

- There is no upper age limit to enroll in the course.

- A distance MBA in Banking and Finance course can be pursued at prominent colleges like IGNOU, IMTS Institute, and a few more.

- For admission to the Distance MBA in Banking and Finance at IGNOU, the candidate needs to clear the CAIIB examination conducted by the Indian Institute of Banking and Finance.

- The average distance MBA in Banking and Finance course fee is in the range of INR 30,000-70,000 PA.

MBA in Banking and Finance Syllabus and Subjects

The MBA in Banking and Finance syllabus in the first year focuses on understanding the fundamentals of business concepts such as finance, business statistics, managerial economics, etc. In the second year, the course focuses on understanding the specifics of working capital management, capital structure, dividend policy, etc.

Below are listed some of the MBA in Banking and Finance subjects in detail:

|

MBA in Banking and Finance Subjects |

Topics Covered |

|

Quantitative Techniques for Management |

Transportation Model, Inventory Model, Types of Simulation, Network Model, etc. |

|

Financial Institutions and Services |

Insurance Industry History, Regulations of Bank Credit, About Banking Institutions, etc. |

|

Merchant Banking |

Role of Financial Intermediaries, Capital Market Structure, Money Market Structure, Indian Financial System Overview, etc. |

|

Strategic Management |

Strategy Formulation Strategies, SWOT Audit, 7S Model, Business Portfolio Strategies, etc. |

Read More: MBA in Banking and Finance Syllabus and Subjects

MBA in Banking and Finance vs MBA in Finance

The MBA in Banking and Finance course focuses on understanding banking operations principles and regulatory frameworks in BFSI industry, whereas the MBA in Finance course soley focuses on advanced knowledge about finance principles and practices. Below is the comparison between an MBA in Banking and Finance and an MBA in Finance:

|

Parameters |

MBA in Banking and Finance |

MBA in Finance |

|

Course |

Masters |

Masters |

|

Full Form |

Master of Business Administration in Banking and Finance |

Master of Business Administration in Finance |

|

Stream |

Management |

Management |

|

Course Overview |

The course covers topics like financial management, investment analysis, and risk management. |

The course covers topics like investment management, financial statement analysis, and corporate finance. |

|

Duration |

2 Years |

2 Years |

|

Eligibility |

Bachelor’s with a minimum of 50-55% marks |

Bachelor’s with a minimum of 50-55% marks |

|

Entrance Exams |

CAT, GMAT, XAT |

CAT, XAT, MAT, CMAT |

|

Top Colleges |

Sharda University, SRMU, etc. |

BITS Pilani, NMIMS, Mumbai, etc. |

|

Fees |

INR 35,000-5 LPA |

INR 2-10 LPA |

|

Average Salary |

INR 4-12 LPA |

INR 3-15 LPA |

| Career Opportunities |

Credit Manager, Insurance Manager, Investment Banker, etc. |

Financial Analyst, Finance Manager, Business Analyst - IT, etc. |

| Skills Acquired |

Banking Operations Management, Investment Banking, Asset Management, etc. |

Corporate Finance Management, Risk Management, Investment Analysis, etc. |

Read More: MBA in Finance

Courses After MBA in Banking and Finance

After completion of the MBA in Banking and Finance course, graduates can enroll in various advanced certification courses and higher education degrees to understand the latest trends in the banking and finance industry, and upskill their skills and knowledge. Below is a list of a few courses that can be pursued after the MBA in Banking and Finance course:

- PhD

- Advanced Certification in International Trade and Finance

- Fintech Certification

- Certified Financial Planner Course

- EMBA in Financial Risk Management

- Advanced Wealth Management Certification Course

Salary of an MBA in Banking and Finance in India

MBA in Banking and Finance graduate salaries range between INR 4-12 LPA. The MBA in Banking and Finance graduate's career options are vast; they can work in both private and public sectors in prominent organizations like Morgan Stanley, Bank of America, Barclays, SEBI, CitiBank, etc. Below are the top job profiles for MBA Banking and Finance graduates:

|

Job Role |

Average Entry Level Salary |

|

Credit Manager |

INR 8.50 LPA |

|

Relationship Manager |

INR 4.44 LPA |

|

Finance Manager |

INR 9.60 LPA |

|

Management Consultant |

INR 7.75 LPA |

[Source: Payscale]

Career Options After Master of Business Administration in Banking and Finance Course

The MBA in Banking and Finance graduate's career options are vast as they can work in different industries/areas, such as the Insurance Industry, Fintech, Real Estate, etc. Below are listed the top job roles along with their job descriptions for MBA Banking and Finance graduates:

|

Job Designations |

Job Descriptions |

Hiring Companies |

|

Investment Banker |

They help their clients by performing various tasks such as capital raising, corporate restructuring, bond issuance, etc. |

HDFC Bank, Wells Fargo, ICICI Bank, etc. |

|

Insurance Manager |

Their primary responsibility involves gathering and reviewing renewal data for corporate insurance contracts while working with brokers and the company. |

Bajaj Allianz Insurance Ltd, Oracle, Max Life Insurance, etc. |

|

Asset Manager |

They evaluate asset risk and need to manage the investment and trading ratio of company's assets such as stocks, capital bonds, etc |

Axis Bank, IDBI Bank, IBM, etc. |

|

Venture Capital Analyst |

They perform extensive market analysis, examining financial records, and evaluating the possible risks and returns of each investment for the company. |

Sequoia Capital, Bank of Baroda, Proficio Advisors, etc. |

Top Recruiters for MBA Banking and Finance Course

MBA in Banking and Finance graduates are recruited by various private and public organizations such as investment banks, private equity firms, commercial banks, etc. Below is a list of top recruiters that hire MBA Banking and Finance graduates:

|

Top Recruiters |

Average Salary |

|

HDFC Bank |

INR 7 LPA |

|

Muthoot Finance |

INR 5 LPA |

|

S&P Global |

INR 12.8 LPA |

|

IndusInd Bank |

INR 6.1 LPA |

|

IDFC Bank |

INR 7 LPA |

Read More: MBA in Banking and Finance Career Scope

MBA in Banking and Finance Scholarships

Students get various scholarships to pursue banking and finance-related management courses from government and private institutions. The scholarship amount varies depending on the student's merit score, financial background, etc.

Below is a list of a few scholarships provided to MBA Banking and Finance students:

|

Scholarship |

Eligibility |

Amount |

|

INR 2,00,000 for two years |

|

|

Candidates studying in classes IX and above |

Up to INR 50,000 |

|

|

Up to INR 1,80,000 |

|

|

PNB Housing Finance Protsahan Scholarship |

|

Up to INR 2,00,000 |

Skills to Excel as an MBA in Banking and Finance Graduate

An MBA in Banking and Finance needs sound technical knowledge and soft skills to excel as a finance and banking professional. Below is a list of skills required by an MBA Banking and Finance graduate:

- Banking Operations Knowledge: The candidate needs to have clarity in applying concepts like loan assessment, credit administration, etc, in day-to-day business operations.

- Quantitative Skills: The graduate needs, in order to make data-driven decisions, to analyze huge amounts of data and conduct statistical analysis, for which strong quantitative skills are required.

- Good Communication Skills: The graduate needs to have a strong grasp of communicative English, as they are the key person to communicate complex financial statements and strategies to stakeholders, and other team members.

- Client Relationship Management: The banking and finance graduate's major job role is to build client relations to drive business growth and increase sales.

- Data Management Skills: In order to analyze the financial data accurately, the graduate needs to be organized and manage the data efficiently to have better operational efficiency, client/customer insights, and implement risk management strategies.

Top MBA in Banking and Finance Colleges

Top Management Entrance Exams

MBA in Banking and Finance Fee Structure

FAQs on MBA in Banking and Finance

Q: What is MBA in Banking and Finance course eligibility criteria?

Q: What is MBA in Banking and Finance course duration?

Q: Which are the top colleges in India offering MBA in Banking and Finance course?

Q: What are the common entrance exams for MBA in Banking and Finance course?

Q: What is the fees for MBA in Banking and Finance?

Q: Can I get a government job after completing an MBA in Banking and Finance course?

Q: What jobs are available after MBA in Banking and Finance course?

Q: What is the average salary of an MBA Banking and Finance graduate?