Table of Contents

UGC NET Commerce syllabus 2025 includes topics related to the concepts of managing, business and commercial aspects with main topics on Business Environment & International Business/Finance/ Accounting/ Auditing tactics/ learning the funnel of business/ to marketing Management/ Legal aspects of Business.

The UGC NET 2025 Subject code for the Commerce syllabus is 08. Candidates must check the detailed syllabus for the commerce paper provided in the sections below.

UGC NET Commerce Syllabus 2025 Unit-Wise

Enlisted in the following is the curated list of UGC NET Commerce syllabus 2025 Units (I-X) with all the relevant topics, helping the students to revise the syllabus topics easily.

- Business Environment and International Business

- Accounting and Auditing

- Business Economics

- Business Finance

- Business Statistics and Research Methods

- Business Management and Human Resource Management

- Banking and Financial Institutions

- Marketing Management

- Legal Aspects of Business

- Income-tax and Corporate Tax Planning

Unit 1: Business Environment and International Business

The topics including UGC NET Commerce Business Environment and International Business are mostly describing studies on political, economic, social, and cultural concepts and elements of the business environment, and the global trading environment.

| Chapters | Topics |

| Concepts and elements of business environment | Economic environment- Economic systems, Economic policies(Monetary and fiscal policies); Political environment; Role of government in business; Legal environment- Consumer Protection Act, FEMA; Socio-cultural factors and their influence on business; Corporate Social Responsibility (CSR) |

| Scope and importance of international business | Globalization and its drivers; Modes of entry into international business |

| Theories of international trade | Government intervention in international trade; Tariff and non-tariff barriers; India’s foreign trade policy |

| Foreign direct investment (FDI) and Foreign portfolio investment (FPI) | Types of FDI, Costs and benefits of FDI to home and host countries; Trends in FDI; India’s FDI policy |

| Balance of payments (BOP) | Importance and components of BOP |

| Regional Economic Integration | Levels of Regional Economic Integration.Trade creation and diversion effects; Regional Trade Agreements: European Union (EU), ASEAN, SAARC, NAFTA |

| International Economic institutions | IMF, World Bank, UNCTAD |

| World Trade Organisation (WTO) | Functions and objectives of WTO; Agriculture Agreement; GATS; TRIPS; TRIMS |

Unit 2: Accounting and Auditing

This unit talks about the combination of accounting to auditing in the commercial world. Accounting involves learning about basic accounting principles, analysis of financial statements that are tracking, reporting, and experimenting on transactions related to finances.

| Chapters | Topics |

| Basic accounting principles | Concepts and postulates |

| Partnership Accounts | Admission, Retirement, Death, Dissolution and Insolvency of partnership firms |

| Corporate Accounting: Issue, forfeiture and reissue of shares | Liquidation of companies; Acquisition, merger, amalgamation and reconstruction of companies |

| Holding company accounts | - |

| Cost and Management Accounting | Marginal costing and Break-even analysis; Standard costing; Budgetary control; Process costing; Activity Based Costing (ABC); Costing for decision-making; Life cycle costing, Target costing, Kaizen costing and JIT |

| Financial Statements Analysis | Ratio analysis; Funds flow Analysis; Cash flow analysis |

| Human Resources Accounting | Inflation Accounting; Environmental Accounting |

| Indian Accounting Standards and IFRS | - |

| Auditing | Independent financial audit; Vouching; Verification ad valuation of assets and liabilities; Audit of financial statements and audit report; Cost audit |

| Recent Trends in Auditing | Management audit; Energy audit; Environment audit; Systems audit; Safety audit |

Unit 3: Business Economics

Deals with the field of applied economics that emphasize more on the objective of financial, organizational, environmental impact and solutions with the behavior of consumers in the business firms.

| Chapters | Topics |

| Meaning and scope of business economics | - |

| Objectives of business firms | - |

| Demand analysis | Law of demand; Elasticity of demand and its measurement; Relationship between AR and MR |

| Consumer behavior | Utility analysis; Indifference curve analysis |

| Law of Variable Proportions | Law of Returns to Scale |

| Theory of cost | Short-run and long-run cost curves |

| Price determination under different market forms | Perfect competition; Monopolistic competition; Oligopoly- Price leadership model; Monopoly; Price discrimination |

| Pricing strategies | Price skimming; Price penetration; Peak load pricing |

Unit 4: Business Finance

With the aim to focus on acquiring the in-depth means of grasping the scope and source of finance, analysis on rate risk and hedging, an international monetary system with the credit and funds with work in the commercial business.

| Chapters | Topics |

| Scope and sources of finance; Lease financing | - |

| Cost of capital and time value of money | - |

| Capital structure | - |

| Capital budgeting decisions | - |

| Working capital management; Dividend decision | Conventional and scientific techniques of capital budgeting analysis |

| Risk and return analysis; Asset securitization | - |

| International monetary system | - |

| Foreign exchange market; Exchange rate risk and hedging techniques | - |

| International financial markets and instruments | Euro currency; GDRs; ADRs |

| International arbitrage; Multinational capital budgeting | - |

Unit 5: Business Statistics and Research Methods

Topics tend to discuss the importance and the application of statistics, probability, data, and research, and measures in the business world.

| Chapters | Topics |

| Measures of central tendency | - |

| Measures of dispersion | - |

| Measures of skewness | - |

| Correlation and regression of two variables | - |

| Probability | Approaches to probability; Bayes’ theorem |

| Probability distributions | Binomial, poisson and normal distributions |

| Research | Concept and types; Research designs |

| Data | Collection and classification of data |

| Sampling and estimation | Concepts; Methods of sampling - probability and nonprobability methods; Sampling distribution; Central limit theorem; Standard error; Statistical estimation |

| Hypothesis testing | z-test; t-test; ANOVA; Chi–square test; Mann-Whitney test (Utest); Kruskal-Wallis test (H-test); Rank correlation test |

| Report writing | - |

Unit 6: Business Management and Human Resource Management

To learn about the functions, structure, principles, leadership in corporate governance or business ethics, culture organizational, personality, management of human resources of Management.

| Chapters | Topics |

| Principles and functions of management | - |

| Organization structure | Formal and informal organizations; Span of control |

| Responsibility and authority | Delegation of authority and decentralization |

| Motivation and leadership | Concept and theories |

| Corporate governance and business ethics | - |

| Human resource management | Concept, role and functions of HRM; Human resource planning; Recruitment and selection; Training and development; Succession planning |

| Compensation management | Job evaluation; Incentives and fringe benefits |

| Performance appraisal including 360 degree performance appraisal | - |

| Collective bargaining and workers’ participation in management | - |

| Personality | Perception; Attitudes; Emotions; Group dynamics; Power and politics; Conflict and negotiation; Stress management |

| Organizational Culture | Organizational development and organizational change |

Unit 7: Banking and Financial Institutions

Ideas behind the role of this topic are to study the overview of the Indian financial system, markets, institutions, regulators, sectors, sector reforms, insurance on banking.

| Chapters | Topics |

| Overview of Indian financial system | - |

| Types of banks | Commercial banks; Regional Rural Banks (RRBs); Foreign banks; Cooperative banks |

| Reserve Bank of India | Functions; Role and monetary policy management |

| Banking sector reforms in India | Basel norms; Risk management; NPA management |

| Financial markets | Money market; Capital market; Government securities market |

| Financial Institutions | Development Finance Institutions (DFIs); Non-Banking Financial Companies (NBFCs); Mutual Funds; Pension Funds |

| Financial Regulators in India | - |

| Financial sector reforms including financial inclusion | - |

| Digitisation of banking and other financial services | Internet banking; mobile banking; Digital payments systems |

| Insurance | Types of insurance- Life and Non-life insurance; Risk classification and management; Factors limiting the insurability of risk; Re-insurance; Regulatory framework of insurance- IRDA and its role |

Unit 8: Marketing Management

The unit itself is also a part of an MBA course in many institutions about the key role of marketing and business, concepts, approaches, decision-making in a product, pricing decisions, promotions, and more under the management.

| Chapters | Topics |

| Marketing | Concept and approaches; Marketing channels; Marketing mix; Strategic marketing planning; Market segmentation, targeting and positioning |

| Product decisions | Concept; Product line; Product mix decisions; Product life cycle; New product development |

| Pricing decisions: Factors affecting price determination; Pricing policies and strategies | - |

| Promotion decisions | Role of promotion in marketing; Promotion methods - Advertising; Personal selling; Publicity; Sales promotion tools and techniques; Promotion mix |

| Distribution decisions | Channels of distribution; Channel management |

| Consumer Behaviour; Consumer buying process; factors influencing consumer buying decisions | - |

| Service marketing | - |

| Trends in marketing | Social marketing; Online marketing; Green marketing; Direct marketing; Rural marketing; CRM |

| Logistics management | - |

Unit 9: Legal Aspects of Business

Focuses on the legal aspects of business, partnership, corporation, and proprietorship with the law including the elements of a valid contract, agreement, provisions with the good and services.

| Chapters | Topics |

| Indian Contract Act, 1872 | Elements of a valid contract; Capacity of parties; Free consent; Discharge of a contract; Breach of contract and remedies against breach; Quasi contracts |

| Special contracts | Contracts of indemnity and guarantee; contracts of bailment and pledge; Contracts of agency |

| Sale of Goods Act, 1930 | Sale and agreement to sell; Doctrine of Caveat Emptor; Rights of unpaid seller and rights of buyer |

| Negotiable Instruments Act, 1881 | Types of negotiable instruments; Negotiation and assignment; Dishonour and discharge of negotiable instruments |

| The Companies Act, 2013 | Nature and kinds of companies; Company formation; Management, meetings and winding up of a joint stock company |

| Limited Liability Partnership | Structure and procedure of formation of LLP in India |

| The Competition Act, 2002 | Objectives and main provisions |

| The Information Technology Act, 2000 | Objectives and main provisions; Cyber crimes and penalties |

| The RTI Act, 2005 | Objectives and main provisions |

| Intellectual Property Rights (IPRs) | Patents, trademarks and copyrights; Emerging issues in intellectual property |

| Goods and Services Tax (GST) | Objectives and main provisions; Benefits of GST; Implementation mechanism; Working of dual GST |

Unit 10: Income-tax and Corporate Tax Planning

Emphasis on the learning of the tax imposed by the government on the wages/income generated by business private/public means.

| Chapters | Topics |

| Income-tax | Basic concepts; Residential status and tax incidence; Exempted incomes; Agricultural income; Computation of taxable income under various heads; Deductions from Gross total income; Assessment of Individuals; Clubbing of incomes |

| International Taxation | Double taxation and its avoidance mechanism; Transfer pricing |

| Corporate Tax Planning | Concepts and significance of corporate tax planning; Tax avoidance versus tax evasion; Techniques of corporate tax planning; Tax considerations in specific business situations: Make or buy decisions; Own or lease an asset; Retain; Renewal or replacement of asset; Shut down or continue operations |

| Deduction and collection of tax at source; Advance payment of tax; E-filing of income tax returns | - |

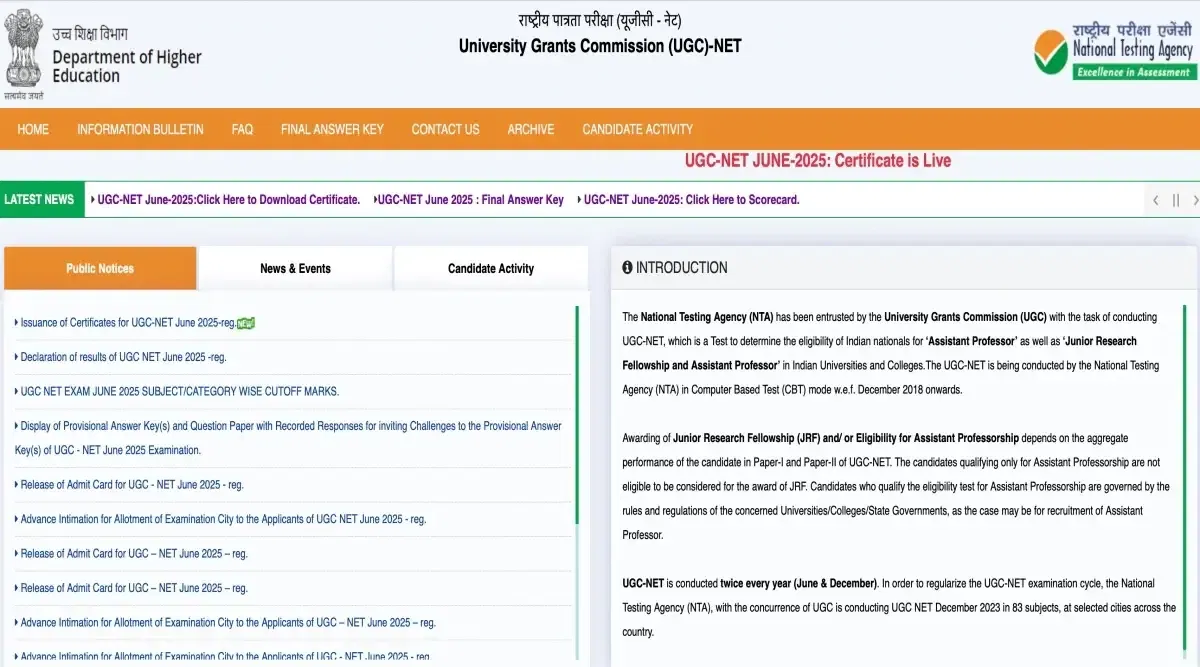

UGC NET Commerce Exam Pattern 2025

The candidates should always head to understand the exam pattern for the UGC NET Commerce section.

Lean on considering the revised syllabus based on:

- Paper-I: Evaluate skills and eligibility based on Teaching and Research Ability

- Paper-II: Questions based on the subjects opted by the candidate choice

| Particulars | Details | |

| Duration of test | 3 hours (180 minutes) | |

| Paper type | Common for UGC NET Paper-I | Subject Specific/Preference-based questions for UGC NET Paper-II |

| Questions type | Multiple Choice Questions (MCQs) | |

| Total Questions | 50 (UGC NET Paper-I) | 100 (UGC NET Paper-II) |

| Mark in Total | 100 (UGC NET Paper-I) | 200 (UGC NET Paper-II) |

| Marking Scheme | No negative Marking, 2 marks per correct response | |

| Language medium | English & Hindi | |

Note: There will be a continuation of the test with no break/short recess from Paper-I to Paper-II unless emergencies/technical glitches.

Best Books for UGC NET Commerce 2025

With all the perfect syllabi displayed above, picking the best books that go according to the commerce syllabus is equally important for competing in the upcoming UGC NET Exam. Now, picking up the listed right books mentioned below for shooting the exam scoring to the next level.

These books are well revised and equally pay satisfaction to the board guidelines.

- Trueman’s UGC NET Commerce: Parveen Kataria, Anshu Kataria and M.Shivani

- Basic Financial Accounting: JR Monga

- UGC NET/JRF/SET Commerce (Paper-II): Dr. L.N. Koli & Madhan Singh

- Graduation textbooks: Maheshwari and Mittal

- NTA UGC NET Commerce Paper-II: RPH Editorial Board

- Financial Management (7th Edition): IM Pandey

- Post Graduation textbooks: V.S.P. Rao

Read More: Books for UGC NET 2025

How to Score More than 120 Marks in UGC NET Commerce Exam 2025?

To score 120 marks in UGC NET, candidates need to work smart and hard. However, getting stressed and landing in a panic situation will not help. Therefore, follow the steps mentioned below to gain more perspective:

- Candidates are advised to read all the topics thoroughly and pay more attention to the areas of weakness.

- Prioritizing any one topic for the exam will not help score good marks. Questions are covered from each section. Hence, deliberate time should be invested in covering each topic.

- Next, candidates must target to achieve more than 120 marks in JRF. 10 questions from each section are compulsory.

- Try and read more general knowledge books. In addition, the candidates must keep themselves updated with current affairs.

- Lastly, candidates must appear for mock tests and complete the revision of the entire syllabus before the exams.