Tamil Nadu Class 12 Accountancy Latest Syllabus 2024-25: Download Latest and Revised Tamil Nadu Class 12th Accountancy Syllabus PDF

Table of Contents

The TN 12th Accountancy syllabus 2024-25 contains nine units. Students should review the syllabus thoroughly and cover all the topics mentioned in the syllabus to attempt all the questions in the TN 12th exam 2024.

The Accountancy subject is one of the core subjects under the commerce stream. The Tamil Nadu 12th Accountancy 2024-25 syllabus provides a holistic understanding of the chapter-wise topics that will be covered during the curriculum.

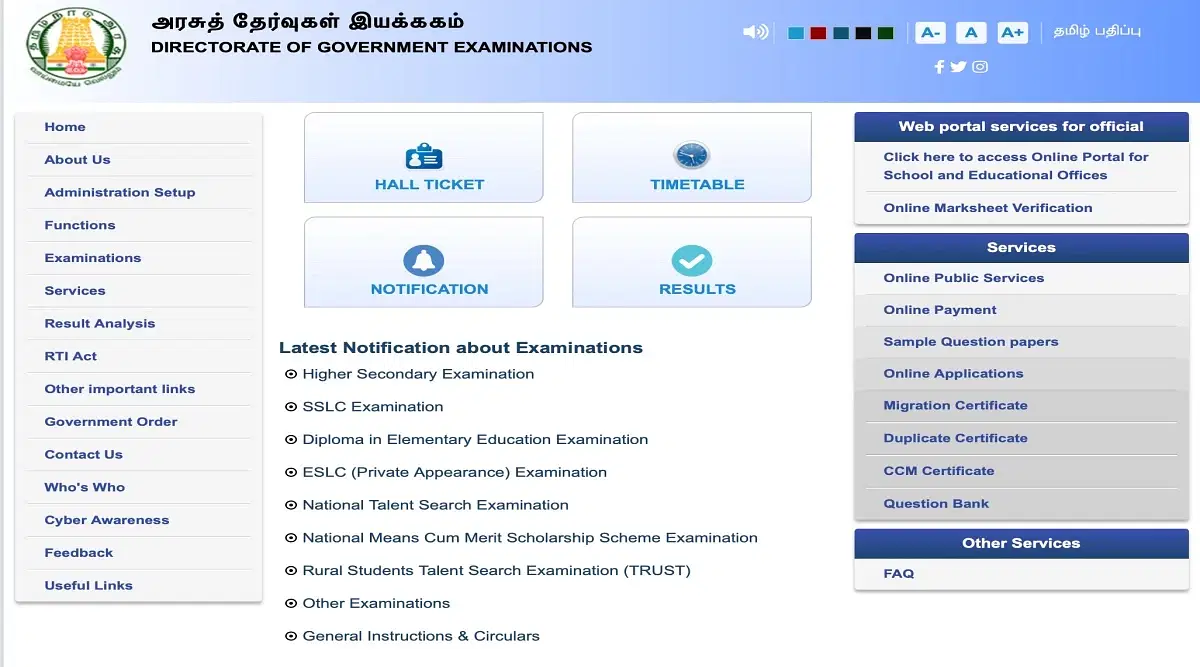

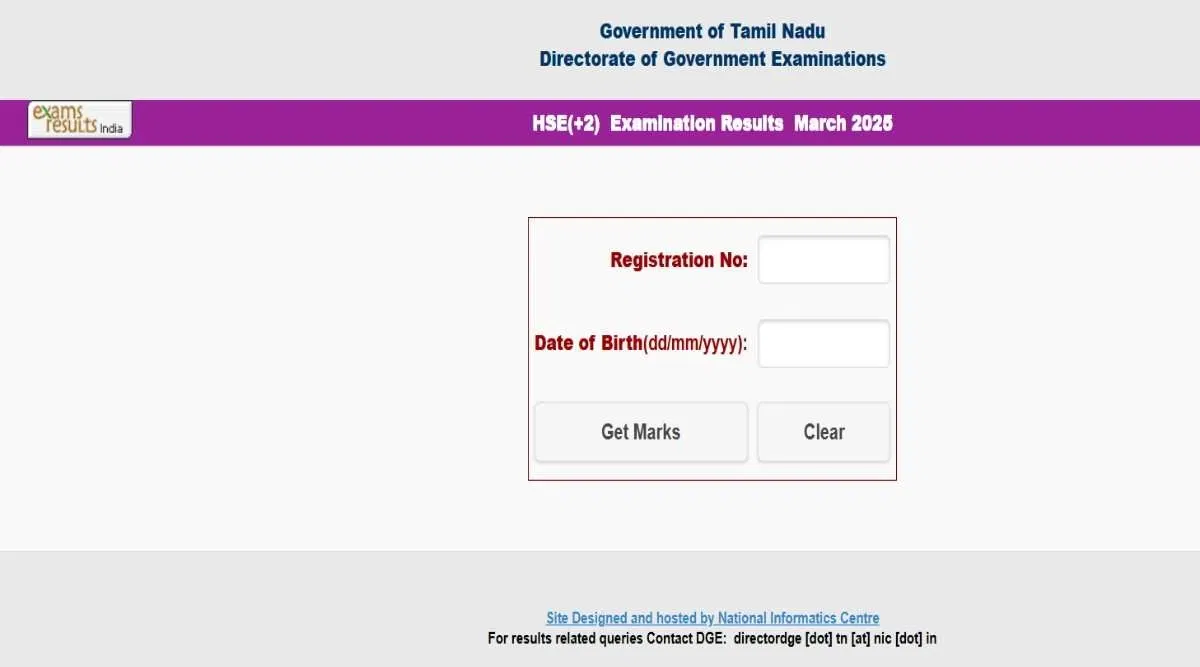

TN 12th Accountancy Syllabus 2023-24: Download PDF

The Tamilnadu State Board has provided the TN 12th 2023-24 Accountancy syllabus on its official website. The table below contains the syllabus of TN 12th exam 2024 which can be downloaded in PDF format.

| Particulars | PDF Link |

| TN 12th Accountancy 2023-24 Syllabus (Tamil) | Download Now |

| TN 12th Accountancy 2023-24 Syllabus (English) | Download Now |

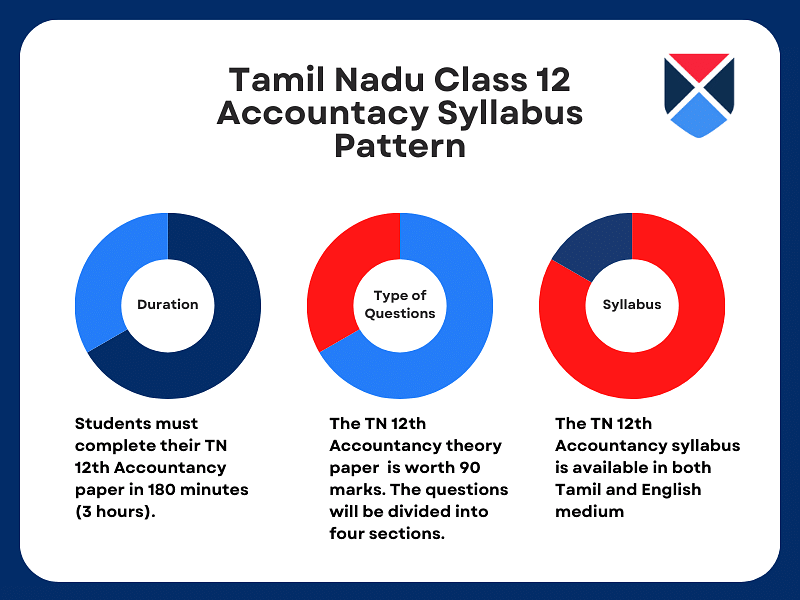

Check the pattern of the TN 12th Accountancy syllabus 2024-25 illustrated below.

Check for All Subjects: TN 12th syllabus 2024-25

TN 12th Accountancy 2024-25 Syllabus: Exam Analysis

Students can learn the detailed analysis of topic allocation and marking scheme in the exam through the Tamil Nadu 12th Accountancy syllabus 2024-25. An in-depth revision of the syllabus can help students know about the TN 12th exam pattern 2024.

A total of 90 marks is allotted for the TN 12th Accountancy exam 2024. The table below illustrates a brief analysis of the TN 12th exam 2024 as per the syllabus.

| Sections | Questions | Marks | Question Type |

| Part I (Knowledge-Based) | 20 | 20 | Objective |

| Part II (Knowledge-Based) | 7 | 14 | Very Short |

| Part III (Conceptual) | 7 | 21 | Short |

| Part IV (Case-Based) | 7 | 35 | Long |

TN 12th Accountancy Syllabus 2024-25: Chapter-Wise

All the chapters and topics are included in the TN 2024-25 12th Accountancy syllabus that will be covered during the academic tenure. The syllabus is curated based on the latest curriculum and exam structure. Check the chapter-wise topics in the syllabus mentioned in the table below.

| Units | Chapters | Sub Topics | No. of Periods |

| Depreciation | Introduction | Meaning | 14 |

| Definition | |||

| Need | |||

| Causes | |||

| Basic terms | Fixed asset | ||

| Life of an Asset | |||

| Residual value | |||

| Obsolescence | |||

| Effluxion of time | |||

| Maintenance | |||

| Replacement | |||

| Methods | Straight Line Method Illustration | ||

| Written Down Value Method | |||

| Sinking fund method | |||

| Annuity method | |||

| Insurance policy method | |||

| Revaluation method | |||

| Calculation of the amount of depreciation | Calculation of Rate of depreciation | ||

| Calculation of Profit or Loss on sale of asset (restricted to purchase and sale of one asset) | |||

| Preparation of Asset Account and Depreciation Account under Straight Line & Written Down method | |||

| Final Accounts Adjustments | Introduction | 24 | |

| Common Adjustments | Closing stock | ||

| Outstanding expenses | |||

| Prepaid expenses | |||

| Accrued incomes | |||

| Incomes received in advance | |||

| Interest on capital | |||

| Interest on drawings | |||

| Interest on loans | |||

| Depreciation | |||

| Bad debts | |||

| Provision for bad & doubtful debts | |||

| Provision for discount on debtors | |||

| Provision for discount on creditors | |||

| Preparation of final accounts with closing stock. Illustration including adjusting entries, transfer entries, and problems with 6 adjustments only | |||

| Interpretation of Financial Statements | Financial statement analysis | Meaning | 28 |

| Significance | |||

| Purpose | |||

| Limitations | |||

| Ratio analysis - Meaning, Role, | Meaning | ||

| Role | |||

| Classification of ratios | Liquidity ratio | ||

| Solvency ratios | |||

| Profitability ratios | |||

| Activity ratios | |||

| Calculation of liquidity ratios and profitability ratios | |||

| Cash Budget | Introduction | 7 | |

| Meaning | |||

| Utility | |||

| Preparation of cash budget as per receipts and payment method | |||

| Accounts from Incomplete Records | Introduction | Meaning | 21 |

| Definition | |||

| Features | |||

| Limitations | |||

| Ascertainment of profit or loss | Statement of Affairs method | ||

| Preparation of statement of profit or loss illustration | |||

| Preparation of statement of affairs | |||

| Conversion method | |||

| The distinction between accounts from incomplete records and double-entry | |||

| Partnership Basic Concepts | Introduction | Meaning | 14 |

| Definition | |||

| Features | |||

| Capital | Fixed capital | ||

| Fluctuating capital | |||

| Preparation of capital accounts | |||

| Distribution of profit | Interest on capital | ||

| Interest on drawings | |||

| Salary, commission to a partner | |||

| Preparation of profit and loss appropriation account | |||

| Goodwill | Meaning and nature | ||

| Factors | |||

| Methods of valuing the Goodwillaverage period, super profit method | |||

| Partnership Admission | Introduction | Adjustments | 28 |

| New profit sharing ratio illustration | calculation of net profit ratio and sacrificing ratio illustration | ||

| Revaluation of assets and liabilities | Increase in the value of assets | ||

| Decrease in the value of assets | |||

| Increase in the value of liabilities | |||

| Decrease the value of liabilities | |||

| Unrecorded assets now recorded | |||

| Unrecorded liabilities now recorded | |||

| Creation of a liability | |||

| Profit or loss on revaluation illustration | |||

| Transfer accumulated profit or loss illustration | |||

| Transfer of accumulated reserve | |||

| Treatment of Goodwill (Revaluation method only) | |||

| Capital brought in by a new partner illustration | |||

| Preparation of revaluation A/c, capital accounts, and balance sheet | |||

| Partnership Retirement | Introduction | Adjustments | 19 |

| Net profit ratio | Calculation of new profit ratio | ||

| Calculation of gaining ratio illustration | |||

| Revaluation of Assets and liabilities | |||

| Transfer of accumulated profit or loss illustration | |||

| Adjustment of Goodwill illustration | |||

| Transfer of reserves illustration | |||

| Transfer of the amount due to the outgoing Partnerillustration | |||

| Preparation of revaluation account, capital accounts, and balance sheet after retirement of a partner illustration | |||

| Accounts of Joint Stock Companies | Introduction | Definition | 35 |

| Characteristics | |||

| Sources of finance | |||

| Share capital | Meaning of shares | ||

| Kinds of shares | |||

| Types of share capital | |||

| Issue of shares | Application | ||

| Allotment | |||

| Calls | |||

| Allotment of shares including oversubscription | Issue of shares at per illustration | ||

| Issue of shares at a premium illustration | |||

| Issue of shares at a discount illustration | |||

| Calls in advance illustration | |||

| Calls in arrears illustration | |||

| Forfeiture of shares meaning and accounting treatment | |||

| Re-issue of forfeited shares | Meaning | ||

| Accounting treatment for the reissue of forfeited shares | |||

| Passing of necessary journal entries and preparation of ledger accounts and balance sheet | |||

How to Prepare With the TN 12th Accountancy Syllabus 2024-25?

Candidates can plan for the TN 12th preparation with the help of the syllabus. Check the following tips to prepare for the TN class 12 exam with the help of the TN 12th 2024-25 Accountancy syllabus.

- Review the syllabus to identify topics with the highest allotted marks and practice accordingly.

- Prioritize essential chapters and topics.

- Build a timetable and routine to cover the whole syllabus.

- Prepare short notes for the last-minute preparation.

- Practice problems based on final accounts and complex entries regularly.

- Take additional help from the reference books for conceptual understanding.

![Bharathidasan Institute of Technology, [BIT] Anna University, Tiruchirappalli](https://media.getmyuni.com/azure/college-image/small/bharathidasan-institute-of-technology-bit-anna-university-tiruchirappalli.jpg)