Kerala Class 12th Accountancy Syllabus 2026: Check Chapter-Wise Topics

The Kerala DHSE prescribes the Class 12th Accountancy syllabus annually. Download it from dhsekerala.gov.in. It covers topics like Receipt & Payments, Income & Expenditure, and Balance Sheets. The 100-mark exam includes 80 marks for theory and 20 for internal assessments. Prepare well to score good marks!

Table of Contents

- Kerala plus two Accountancy Syllabus 2026

- Kerala plus two Accountancy Syllabus 2026: PDF Download

- How to Download Kerala plus two Accountancy Syllabus 2026

- Important Topics for Kerala plus two Accountancy Syllabus 2026

- Best Books for Kerala plus two Accountancy Syllabus 2026

- Preparation Tips Kerala plus two Accountancy Syllabus 2026

The Kerala plus two Accountancy syllabus is prescribed every year by Kerala State board of higher secondary education (DHSE). Candidates download the 12th Accountancy syllabus for Kerala board from their official website i.e. dhsekerala.gov.in. The syllabus consists of topics such as Receipt and payments accounts, Income and expenditure accounts, Balance sheets, and others.

The plus two accountancy exam is conducted by board for a total of 100 marks. This exam consists of two parts, one is theory, comprising 80 marks and another is internal assessments of 20 marks. By following the Kerala plus two Accountancy syllabus and sample papers, students can score good marks in the exam with thorough preparation. Candidates can check this article to learn more about Kerala plus two Accountancy syllabus.

Also Read: Kerala Plus Two Exam 2026

Kerala plus two Accountancy Syllabus 2026

The Kerala plus two accountancy syllabus is divided in two parts each designed to provide a deep understanding in every niche under accounting. Here is the table comprising chapter wise details and topics.

|

Part I |

|

|

Chapter |

Topics |

|

Accounting for Not-for-profit organisation |

|

|

Accounting for partnership: Basic concepts |

|

|

Reconstitution of partnership firm: Admission of a partner |

|

|

Reconstitution of a partnership firm: Retirement/death of a partner |

|

|

Dissolution of a partnership firm |

|

|

Part II |

|

|

Chapter |

Topics |

|

Accounting for share capital |

|

|

Issue and redemption of debentures |

|

|

Financial statement of a company |

|

|

Analysis of financial statements |

|

|

Accounting Ratios |

|

|

Cash flow statements |

|

Also Read: Kerala Plus Two Syllabus

Kerala plus two Accountancy Syllabus 2026: PDF Download

Candidates can click on the link given below to download Kerala plus two accountancy syllabus PDF

How to Download Kerala plus two Accountancy Syllabus 2026

Here are detailed steps to download the Kerala plus two accountancy syllabus from the official website.

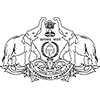

- Step 1: Visit official website of Kerala board, ie dhsekerala.gov.in

- Step 2: Find the section named “Kerala plus two syllabus 2024-25” on the home page.

- Step 3: Select “Accountancy” from the subject list.

- Step 4: Save the PDF to your device or take a printout for future reference.

Important Topics for Kerala plus two Accountancy Syllabus 2026

The topics like accounting for Not-for-profit organisation, reconstitution of partnership firms, and accounting of share capital consists of the highest weightage in Kerala plus two accountancy syllabus. However each topic has its own significance and is to be covered for a decent score in the final examination. Here is the detailed description of the weightage of each topic in the syllabus.

|

Topic |

Weightage |

|

Accounting for Not-for-profit organisation |

10 |

|

Accounting for partnership: Basic concepts |

5 |

|

Reconstitution of partnership firm: Admission of a partner |

10 |

|

Reconstitution of a partnership firm: Retirement/death of a partner |

7 |

|

Dissolution of a partnership firm |

8 |

|

Accounting for share capital |

11 |

|

Issue and redemption of debentures |

5 |

|

Financial statement of a company |

4 |

|

Analysis of financial statements |

4 |

|

Accounting Ratios |

8 |

|

Cash flow statements |

8 |

Also Read: Kerala Plus Two Sample Papers

Best Books for Kerala plus two Accountancy Syllabus 2026

However, there are many books available in the market to cover Kerala plus two accountancy syllabus comprehensively. Here we have some of the books with updated syllabus.

- Accountancy for Class XII – Kerala Board

Author: SCERT Kerala

Publisher: SCERT Kerala

- NCERT Accountancy for Class 12 – Part 1 & Part 2

Author: NCERT

Publisher: National Council of Educational Research and Training (NCERT)

- Double Entry Bookkeeping: Accountancy Class XII

Author: T.S. Grewal

Publisher: Sultan Chand & Sons

- Accountancy: Principles and Practices for Class XII

Author: D.K. Goel

Publisher: Avichal Publishing Company

- Accountancy Class 12 Part 1 & Part 2

Author: P.C. Tulsian

Publisher: S. Chand

Preparation Tips Kerala plus two Accountancy Syllabus 2026

Here are some expert curated personalised tips to prepare for Kerala plus two accountancy syllabus.

- Understand the syllabus and concepts: The key to success in a subject is understanding its syllabus and knowing your level of understanding of that particular subject. Especially for subjects like accountancy, understanding the concept is very important for excellence.

- Practise regularly: The key to master accountancy is practice, practice as much as you can, try solving textbook questions from previous year papers and sample papers.

- Create summary notes: To avoid last minute hustle, keep your summary notes ready that will provide a quick revision filling up the small gaps in your preparation.

- Focus on time management: In the final examination time management is very important to cover each and every question. For effective time management try solving sample papers within a particular time limit.

![Christian College, [CC] Alappuzha](https://media.getmyuni.com/azure/college-image/small/christian-college-cc-alappuzha.jpg)

![Milad E Sherif Memorial (MSM) College, [MSMC] Alappuzha](https://media.getmyuni.com/azure/college-image/small/milad-e-sherif-memorial-msm-college-msmc-alappuzha.jpg)